Consumer Closeness in the

Age of Social Distancing

July 2020: Consumer Packaged Goods

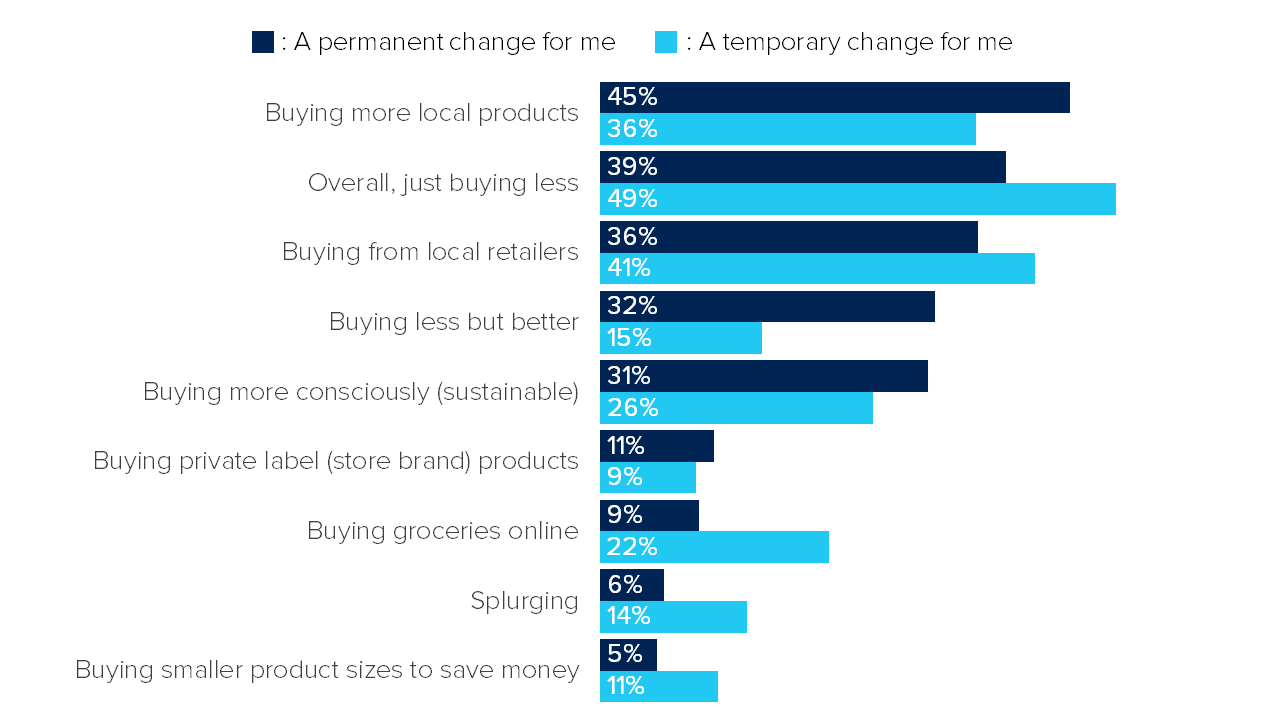

As the pandemic carries on, consumers are settling into their new routines and relationships with brands. While many Canadians are itching to get back to brick and mortar stores, the sentiment around buying less & local is here to stay.

The consumer value equation is changing as more people report shopping online, buying private label products and being more conscious of what they purchase. But for some, shopping for groceries online is less likely to be a permanent change.

How would you characterize recent changes in your spending behavior?

Given this changing value equation, brands need to engage directly with consumers to continually challenge their assumptions. Is your brand prepared for the post-COVID-19 pandemic consumer mindset?

Connect with a Reach3 consultant to discuss: ?

With this uncertain future, consumers are opting to engage in safer shopping methods (i.e. contactless, online) & saving money wherever they can.

Canadian consumers are keen on engaging in safe commerce, favoring contactless payment options & shopping online. They’re also penny-pinching wherever they can; turning away from premium brands and embracing less expensive products.

%

Doing less

Switched to contactless payment methods

%

Doing more

%

Doing less

Shopping online & getting delivery

%

Doing more

%

Doing less

Choosing less expensive brands/products

%

Doing more

%

Doing less

Choosing premium brands

%

Doing more

Brands that provide good value and are readily available have opportunity to build loyalty with consumers that will remain post-pandemic.

What types of product brands do you think you’ll value the most after the pandemic?

%

Good Value

%

Locally Sourced

%

Reflects Consumer Values

Which brands and companies during the COVID-19 situation have best provided value to their customers?

Does your brand need to actively listen to its consumers? Click the button below to connect with a Reach3 consultant on how to do this: ?

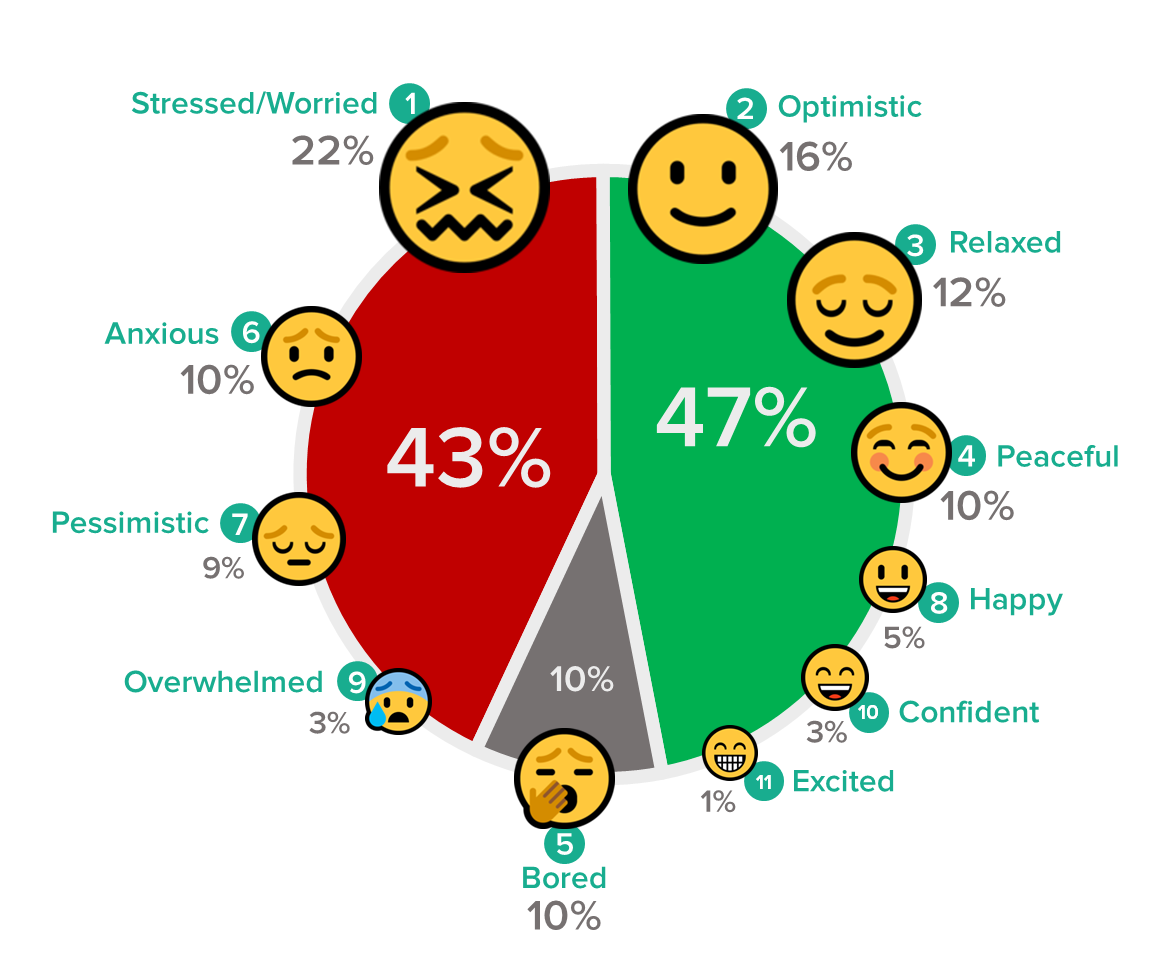

As COVID-19 continues to spread throughout the world (& especially in the US), Canadian consumers have mixed feelings about everything going on around them.

While consumers are split equally between positive and negative sentiment, CAUTION still prevails.

“Thinking about all that has happened in the last two weeks, how are you feeling today?”

“How are you feeling that things are starting to open up soon?”

(Top 3 Emotions)

Cautiously Optimistic (52%)

Worried (23%)

Unsure (14%)

To help deal, Canadians are spending more time at home…but not everyone in the household is happy about it.

Which of these activities are you doing MORE often compared to before COVID-19?

(Top 3 Activities)

Watching TV shows/movies/news

Cooking from scratch

Spending time with family

With everyone at home ‘all the time’, what is driving you crazy?

Are your consumers going to come out of the lockdown a hunk ?, a chunk ?, or drunk ?? Talk to a Reach3 consultant about how we can help you better anticipate where your consumer is headed.

Click the button below to start a conversation: ?

Catch up on past reports: Click here.

A word on our approach

This research is not just another COVID-19 survey. This study was conducted using immersive mobile messaging-based conversational exercises that capture robust quant data and emotive qual inputs in real-time from our mobile COVID-19 community members in one seamless experience. Take a look at the video to see a demo of how our technology works…

Fine Print:

Field dates 6/26-7/7, Base: n=206

Want to share with your team & discuss the report with a research consultant from Reach3 Insights?

Email info@reach3insights.com or

use the contact button below.

www.reach3insights.com

info@reach3insights.com // SMS: (833) 4Reach3 // Phone: (833) 4Reach3