The Digital Seasonal Shopper Experience 2022

In this first ‘post-pandemic’ holiday season, there were mixed feelings about shopping

While shopping was joyful and easy for some, crowds, fulfillment issues, and inflation dampened the mood for others

Feelings about holiday shopping in 2022

The Good

Shopping and gifting as an expression of love / reconnecting ?

Shopping & seeking deals was enjoyable ?

The Bad

Crowds & competition for deals ?

Out-of-stock & fulfillment problems ?

Inflation & high prices ?

Although I was able to find what I wanted online, the companies weren’t able to deliver it in the required time due to some processing issues and also weather, which really wasn’t a big problem…The packages weren’t delivered in time for Christmas, which was extremely disappointing.

-Male, 46-50, Ontario

I bought things for my loved ones and it felt good shopping the deals and getting what I could finally afford for my family and friends, it meant the world to me when they opened their gifts in front of me and loved it.

– Male, 18-24, British Columbia

I felt like shopping during this holiday was overwhelming. There was a lot of people in stores and they were quite busy. Also, price for items went up with inflation; it’s as if everyone was looking for rebates, which made some items on sale difficult to find.

– Female, 18-24, Quebec

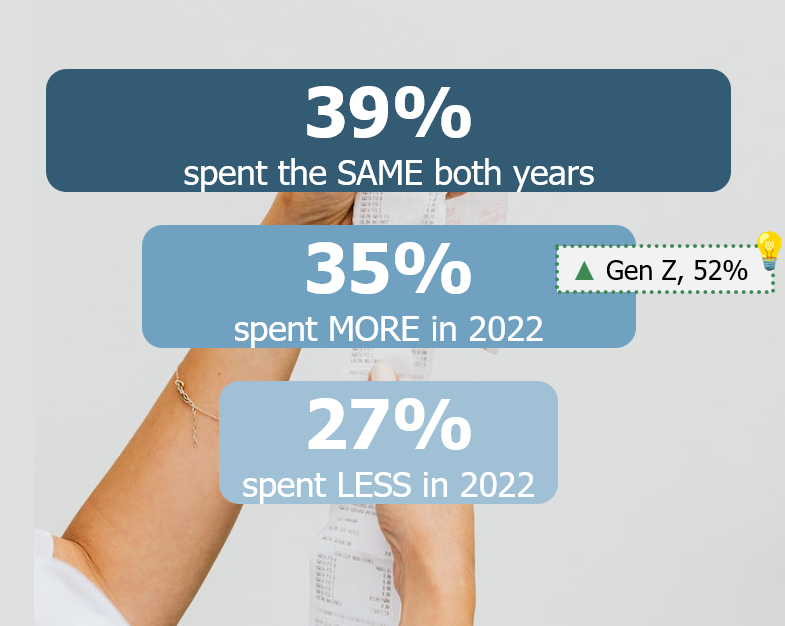

The majority did not report spending less year over year, purchasing for others and for themselves

What they spent money on

- Gifts for others ? 94%

- Items for myself ?♀️ ? 72%

- Items for my home/household ? 51%

- Items for others (not gifts) ? 32%

?: Gen Z significantly higher vs. other age cohorts at 95% CL

Holiday spending vs. 2021

Many took advantage of savings on big shopping days

%

Shopped Black Friday

%

Shopped Cyber Monday

The majority shopped across channels. More shoppers returned to stores in 2022

%

Shopped both online & in-store this holiday season

Channels Shopped

- Online, Items Delivered ?? 96%

- In-store ? ? 83%

- BOPIS ?? 24%

?Higher vs. Holiday 2021 at 95% CL

Issues encountered when shopping online can impact seasonal shopper decisions

Digital shoppers turned to online marketplaces and retailer websites, but it’s worth keeping an eye on DTC and shopping on social media

How they shopped online

%

On online marketplaces

%

On store/retailer website

%

Directly from brands on their website

%

Links posted on social media

Out of stock and slow delivery continue to be key eComm pain points

%

reported some sort of issue when shopping online

Top issues while shopping online

- Items were out of stock or unavailable 40%

- Delivery price was too high ? 29%

- Items would not be delivered on time for the holidays 27%

- Delivery options were too slow 18%

- Delivery tracking was inaccurate / unavailable 16%

- Returns-related issues ?? 12%

- Preferred delivery method was unavailable 11%

?: Gen Z’s significantly higher vs. older age cohorts at 95% CL

?: Millennial’s significantly higher vs. older age cohorts at 95% CL

Retailers need to address pain points, as issues push many consumers to alternate online retailers

Impact of encountering issues

(Among those who encountered an issue)

%

Shopped at a different retailer online

%

Shopped more in-store

%

Did less shopping overall

Retailers can look to current and emerging digital shopper needs to delight shoppers in Holiday 2023

Looking ahead, shoppers want order tracking, guaranteed in-stock, fast delivery, & easy, lenient return policies

TOP things digital shoppers want for Holiday 2023

- Order tracking 72%

- Guaranteed in-stock 54%

- NET Same/Next day delivery 54%

- Guaranteed delivery window 47%

- Option to receive items in the fewest deliveries/packages 45%

- Extended window for returns 36%

- Returns picked up from home 35%

- NET Sustainable delivery or packaging options 34%

- Option to have item gift wrapped/shipped in gift packaging 30%

- Contactless delivery 29%

- BOPIS 29%

- NET Ability to explore/try on items in VR/AR 24%

- Option to have packages sent to multiple addresses 22%

- Pre-sale access for VIP members or select customers 20%

Explore opportunities to leverage AR / VR experiences to differentiate and engage with shoppers

Emerging Trends in AR & VR

%

are interested in exploring or trying on items in AR / VR

What’s this all about?

At Reach3 Insights, we recently leveraged Rival Technology to engage with n=407 Canadian adults who did at least some of their 2022 holiday shopping online.

Our approach engages with shoppers via modern mobile messaging networks to maximize both the representativeness and richness of insights. We’re excited to share what we learned about shoppers’ sentiments and behaviors related to holiday shopping 2022.

Research Details:

N=407 Canada, aged 16+

Field dates Jan 3-9, 2023

Curious to know more?

Use the Contact button below to get in touch or email…

Dara St. Louis ? dara.stlouis@reach3insights.com

Christine Nguyen ? christine.nguyen@reach3insights.com

www.reach3insights.com

info@reach3insights.com // SMS: (833) 4Reach3 // Phone: (833) 4Reach3