Defining ‘Sustainable’ and ‘Premium’ in the Minds of Consumers

Here Are 3 Things You Need to Know

1. Consumers are not confident in what it means to be a sustainable product.

Given the high uncertainty surrounding sustainability, and some mistrust in brands given the “greenwashing” that has occurred, consumers need a resource that can help clear the air when it comes to understanding what is/isn’t sustainable these days.

%

Consumers are unsure of what qualifies as sustainable

While they may be unsure how to accurately spot a sustainable product, consumers show a strong interest in shopping as sustainably as possible.

%

Consumers want to shop sustainably but don’t know where to start

If I believe I am buying something that is truly sustainable then I’m making an investment in my future and the future of the world.

- Agree shopping sustainably is investing in the future 66%

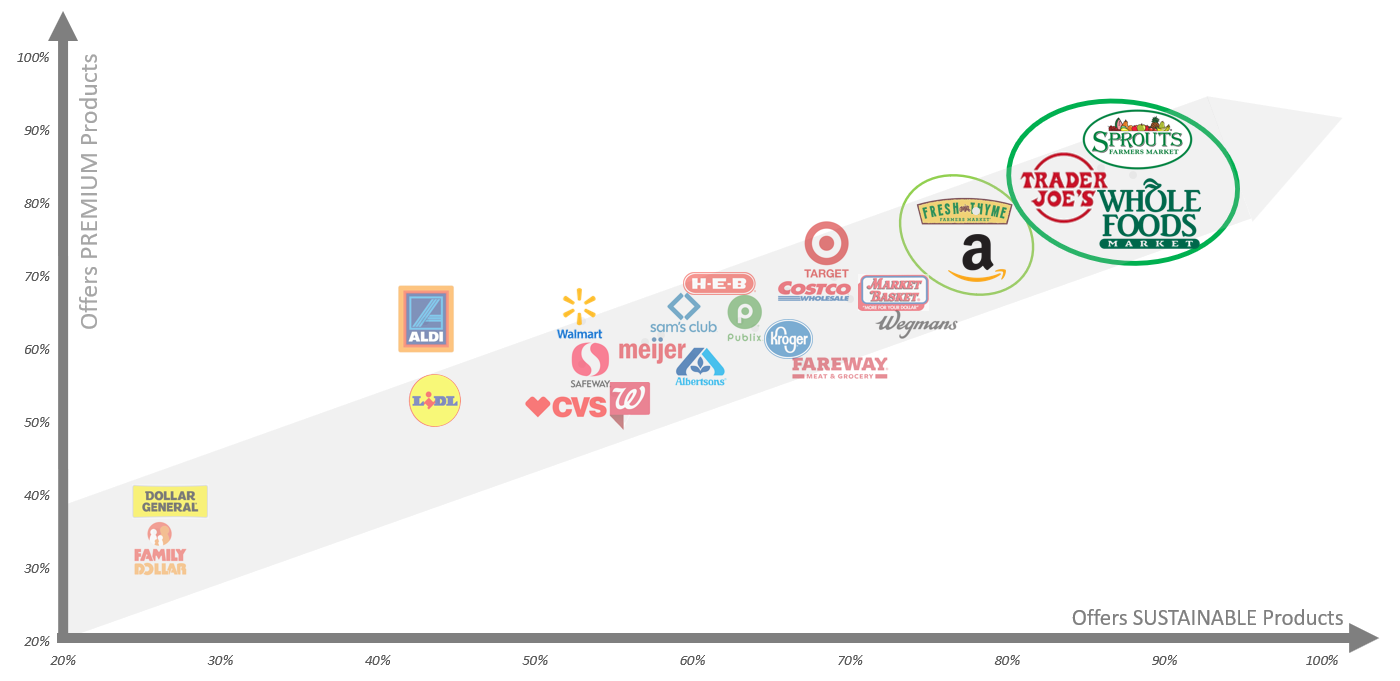

2. Shoppers look to retailers as a guide to understand sustainability, as perceptions of whether or not a retailer offers premium products are linked to perceptions of sustainable offerings.

In the minds of shoppers, there is a strong correlation between a retailer being seen as premium and being seen as sustainable. There’s an opportunity to drive the perception of being a premium retailer by focusing on sustainable products and initiatives.

Retailers Hitting the Mark

3. The definition of ‘premium’ is changing and is more complex than ever.

%

Agree that a premium product should offer more than being just the highest quality

When asked what premium means to them, consumers mention sustainability, waste reduction and being socially responsible.

A word on our approach

This study was conducted using Rival Technology’s mobile messaging-based research platform. Reach3 Insights developed a comprehensive yet immersive conversational-style survey to understand the intersection of three trends – Sustainability, Inflation and Premiumization – and their impact on a variety of CPG categories, and retailers. Both quantitative and qualitative (e.g., photo uploads and video selfie open-ends) data was collected to fuel the results shown in this report.

Who we chatted with: N=2000 US Adults (Age 18+), representative to US census

Field dates: June 30th – July 15th

Curious to know more?

Email marketing@reach3insights.com or

use the Contact button below.

www.reach3insights.com

info@reach3insights.com // SMS: (833) 4Reach3 // Phone: (833) 4Reach3