Understanding the Economic Impact on Canadian Consumers

May 2025

Brought to you by:

Canadians know tariffs are taxes that get passed down to consumers and are worried about the impact they can have on cost of doing business.

%

are very/somewhat confident they know what tariffs are…

75% described their feelings about the current economic landscape as negative—underscoring widespread concern and disdain for US economic policy

M, 51

M, 55

F, 54

Overall Mood

82% described their feelings about the current economic landscape as negative—underscoring widespread concern.

Pessimistic

20%

Anxious

19%

Stressed

15%

Frustrated

13%

Top Emotions indicated above

Optimism is low across the board - especially when it comes to personal finances.

Many Canadians rate their general outlook on the future in the lowest range, and around one in ten feel highly optimistic. When asked specifically about their financial future, responses remain subdued, but there is a little more positivity.

Level of optimism about the future

- 8-10 7%

- 5-7 49%

- 1-4 43%

Level of optimism about financial future

- 8-10 14%

- 5-7 52%

- 1-4 35%

*10 being very optimistic on the scale

Canadians foresee spending cuts on the horizon starting with non-essentials

With 69% expecting new US tariffs and even more expressing concern about their personal impact, consumers are not only aware of what’s coming—they’re anticipating consequences that could influence their financial choices in the near term.

%

believe that new US tariffs are likely to go into effect in the next few months

%

are very/somewhat concerned about the impact it will have on them

Plans to cut spending 👇

Plans before Tariffs go into place

With tariffs looming, consumers are already taking action—trimming spending, stockpiling essentials, and preparing to trade down.

%

Cut back discretionary spending

%

Switch to more affordable brands

%

Delay purchasing

%

Buy local

%

Careful budgeting

%

Buying Smaller quantities

Categories that are expected to be impacted the most include groceries, personal electronics, savings, household essentials and clothing

Anticipating Biggest Impact on…

- Grocery Prices 78%

- Overall Economy 66%

- Household Budget 45%

- Ability to Save or Invest 44%

- Electronics & Tech 40%

- Travel & Transportation 36%

- Household Essentials 36%

- Gas & Home Energy 33%

- Clothing & Accessories 31%

Categories most sensitive to price changes

It’s not just that people expect prices to rise—they’re especially sensitive to where those increases happen. Groceries, personal electronics, food away from home, household supplies, and clothing top the list of price-sensitive categories

Groceries

%

Food away from home

%

Travel & vacations

%

Household Supplies

%

Personal electronics

%

Transportation & travel

%

Finances & bills

%

Personal care items

%

Other categories: Appliances (23%), Energy & utilities (23%), Clothing & footwear (23%), Streaming subscriptions (22%), Tools/Home improvement (20%).

Canadians expect empathy and support from the brands they buy.

Canadians want brands to act with integrity—avoiding price hikes that feel opportunistic and offering real value during tough times.

Canadians Message to brands:

Companies should consider less profits by not raising price in order to keep the customers.

Now is the time to show up for your clientele. Add value, don’t price-gouge, and be genuine

This is not the time for huge profits. When the majority of people are struggling it is time to help

That they shouldn’t jack up prices on Canadian items to capitalize off of peoples patriotism.

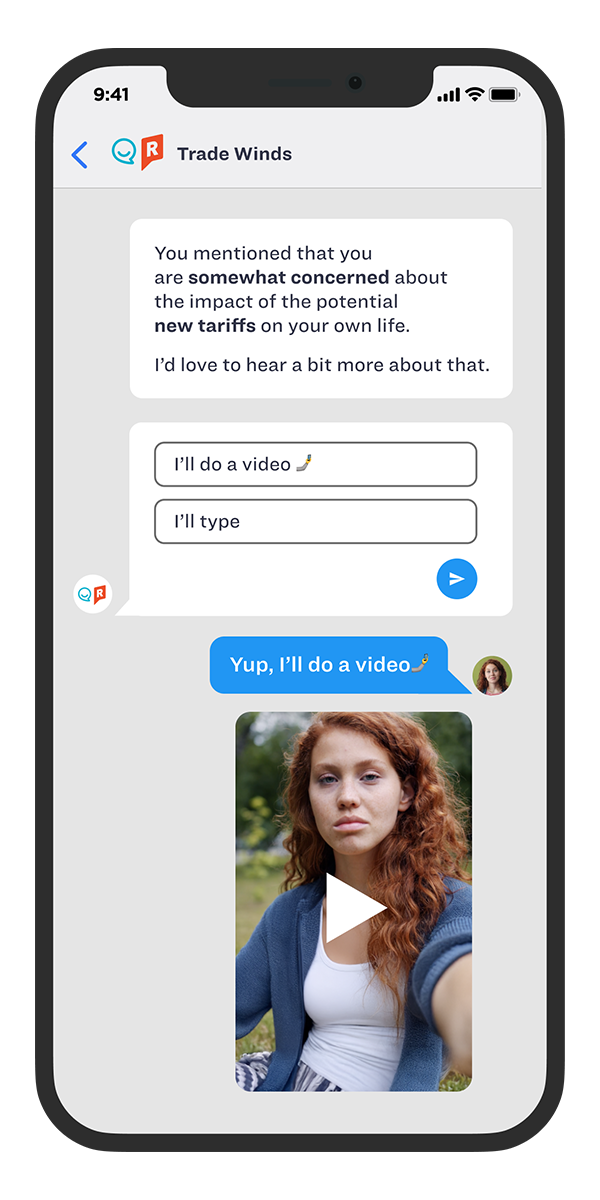

A word on our approach...

Fine Print:

A Nationally Representative Angus Reid Group Sample

Sample Size: n=2,419 & n= 305 Canadians aged 18+ years old

Fieldwork dates: April 25-May 2, 2025

Mobile Chat

Coming Soon:

Over the next several months, we’ll be diving deeper into how tariffs and economic uncertainty are shaping everyday life. From grocery shopping habits and travel plans to the impact on media consumption, personal wellness, big-ticket purchases, and budgeting strategies — we’ll explore it all. We’ll also cover shifting consumer trust in brands and retailers, impulse spending trends, and how special occasions and summer holidays are being affected.

Stay tuned for fresh insights!

Curious to know more?

Email marketing@reach3insights.com or

use the Contact button below.

www.reach3insights.com

info@reach3insights.com // SMS: (833) 4Reach3 // Phone: (833) 4Reach3