Understanding the Economic Impact on US Consumers

May 2025

Brought to you by:

30 days since "Liberation Day"...most Americans understand that tariffs are essentially taxes that raise prices, contributing to a more pessimistic outlook on their finances.

%

are very/somewhat confident they know what tariff are…

F, 32, Midwest

M, 45, South

F, 57, South

Overall Mood

74% described their feelings about the current economic landscape as negative—underscoring widespread concern.

Stressed

17%

Pessimistic

14%

Frustrated

13%

Anxious

10%

Top Emotions indicated above

Optimism is low across the board - especially when it comes to personal finances.

~Half of Americans rate their general outlook on the future in the lowest range, and just one in five feel highly optimistic. When asked specifically about their financial future, responses remain subdued, with nearly as many people feeling pessimistic as those expressing moderate hope.

Level of optimism about the future

- 8-10 20%

- 5-7 30%

- 1-4 50%

Level of optimism about financial future

- 8-10 18%

- 5-7 41%

- 1-4 41%

*10 being very optimistic on the scale

To cope with rising costs from tariffs, consumers say they expect to cut back on non-essentials, choosing cheaper options even if it means lower quality, and keeping an eye out for the best deals.

With 75% expecting new US tariffs and an equal share expressing concern about their personal impact, consumers are not only aware of what’s coming—they’re anticipating consequences that could influence their financial choices in the near term.

%

believe that new US tariffs are likely to go into effect in the next few months

%

are very/somewhat concerned about the impact it will have on them

Plans to cut spending 👇

Plans before Tariffs go into place

With tariffs looming, consumers are already taking action—trimming spending, stockpiling essentials, and preparing to trade down.

%

Cut back discretionary spending

%

Start Budgeting

%

Switch to more affordable brands

%

Delay a Purchase

%

Buy Smaller Qty.

%

Buy Used / Second hand

%

Stock up on HH essentials

%

Buy Local

%

Change Stores Shopped

%

Make Large Purchases Sooner than Planned

%

Buy Gifts earlier

%

No Action

Categories that are expected to be impacted the most include groceries, personal electronics, household essentials and clothing

Anticipating Biggest Impact on…

- Grocery Prices 67%

- Overall Economy 54%

- Electronics & Tech 52%

- Household Essentials 47%

- Household Budget 47%

- Clothing & Accessories 46%

- Healthcare 41%

- Ability to Save 40%

- Gas or Home Energy 39%

- Ability to Pay Bills 36%

- Travel or Transportation 35%

- My Job 23%

Categories most sensitive to price changes

It’s not just that people expect prices to rise—they’re especially sensitive to where those increases happen. Groceries, personal electronics, food away from home, household supplies, and clothing top the list of price-sensitive categories

Groceries

%

Personal Electronics

%

Food away from home

%

Household Supplies

%

Clothing

%

Appliances

%

Other categories: Home Tech (29%), Transportation (29%), Healthcare (29%), Energy & utilities (28%), Finances & Bills (26%), Travel/Vacations (26%), Personal care items (24%), Tools/Home improvement (20%), Beauty (16%), Alcoholic beverages (15%), Live entertainment (13%), Streaming subscriptions (13%), Baby products (6%).

Americans expect empathy and support from the brands they buy.

Americans want brands to act with integrity—avoiding price hikes that feel opportunistic and offering real value during tough times.

Americans’ Message to brands:

Promote quality instead of quantity. Reward loyalty to your particular brand with incentives, discounts, perks. Maybe announce a freeze or cut back on top executive salaries as an example of good faith.

I understand that this means I will have to pay more, they need to understand it also means I will buy less.

Take it easy on the public when passing along the cost of tariffs, don’t be too greedy!

To the brands we use and love, it’s not personal that we are cutting back or just not purchasing, we just have to be more cautious due to the tariff policy that will hurt consumers in the long run.

Don’t use the tariffs as a pretext to raise prices to increase your profit margins.

We the people are feeling uneasy about our economy, our financial situation and times seem to be getting harder before the ease for us the people.

We’re burned out, stressed and tired. And now what few comforts the majority of us cling to to relieve stress are being priced out of our range.

Frustrated they are making packages and quantities smaller but jacking up the prices.

A word on our approach...

Fine Print:

A Nationally Representative Angus Reid Group Sample

Sample Sizes: n=1,533 & n=303 Americans aged 18+ years old

Fieldwork dates: April 25-May 2, 2025

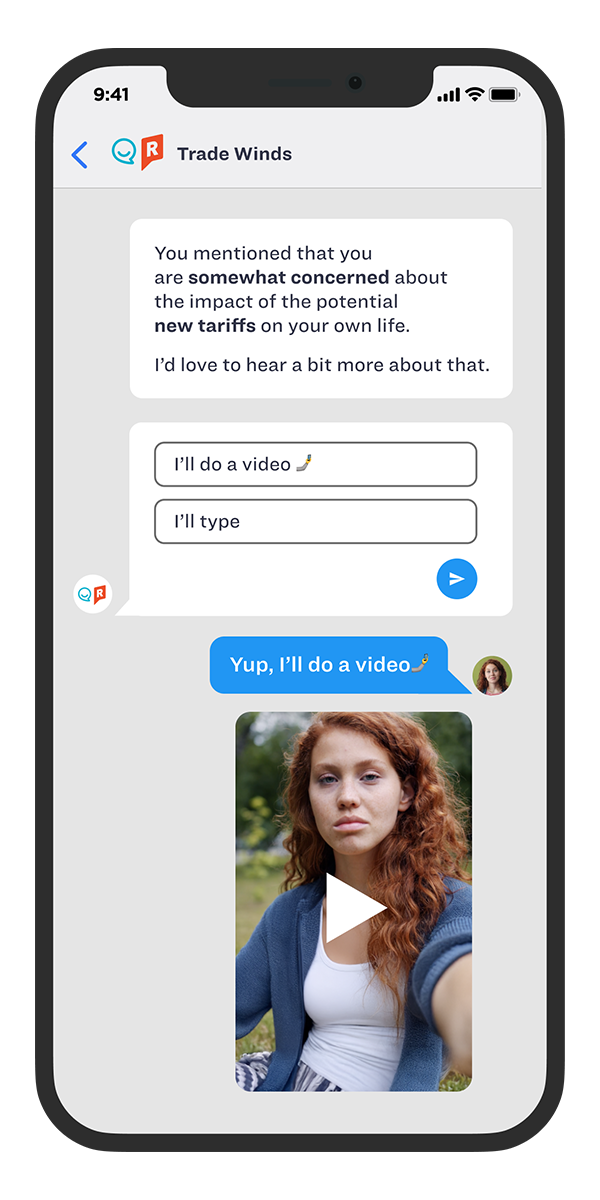

Mobile Chat

Coming Soon:

Over the next several months, we’ll be diving deeper into how tariffs and economic uncertainty are shaping everyday life. From grocery shopping habits and travel plans to the impact on media consumption, personal wellness, big-ticket purchases, and budgeting strategies — we’ll explore it all. We’ll also cover shifting consumer trust in brands and retailers, impulse spending trends, and how special occasions and summer holidays are being affected.

Stay tuned for fresh insights!

Curious to know more?

Email marketing@reach3insights.com or

use the Contact button below.

www.reach3insights.com

info@reach3insights.com // SMS: (833) 4Reach3 // Phone: (833) 4Reach3