Understanding the Impact of Tariffs on Shopping Behaviors

June 2025

Brought to you by:

Canadian consumers remain largely pessimistic about US trade policy and the economy, with a bleak outlook on the future

%

of Canadians Feeling Negative About Future -

vs 75% in late April

Pessimistic

20%

Unchanged vs late April

Anxious

17%

vs 19% in late April

Frustrated

14%

vs 13% in late April

Stressed

10%

vs 15% in late April

Consumer sentiment has remained relatively stable compared to late April, even as U.S. trade policy tensions ease. Notably, optimism is slightly higher when it comes to Canadians’ financial outlook, suggesting some separation between general uncertainty and personal finances.

Level of optimism about the future

- 8-10 (vs 7% in late April) 9%

- 5-7 (Unchanged vs late April) 49%

- 1-4 (vs 43% in late April) 42%

Level of optimism about financial future

- 8-10 (vs 14% in late April) 20%

- 5-7 (vs 52% in late April) 45%

- 1-4 (vs 35% in late April) 35%

*10 being very optimistic on the scale

Nearly half of consumers (49%) see stocking up on essentials as important — a signal of continued caution in how people plan for uncertainty. While only a quarter (24%) have already acted on this concern, a much larger group (43%) are actively considering it.

%

Feel as though stocking up is essential / somewhat important

Approach to stocking up

- Have stocked up 24%

- Are considering stocking up 43%

- Are not considering it 33%

Categories stocked up / considering stocking up

Among those stocking up or considering it, the focus is clearly on daily-use categories — groceries (71%), household supplies (57%), and personal care items (44%) are leading the list. Categories like electronics, baby products, and appliances remain lower priority for now

- Groceries 71%

- Household supplies 57%

- Personal care items 44%

- Healthcare items 18%

- Beauty / grooming products and services 15%

- Clothing/footwear 15%

- Alcoholic beverages 12%

- Tools / home improvement items / construction materials 11%

- Personal electronics 7%

- Baby/childcare products 6%

- Appliances 5%

Other Items: Transportation (4%), Travel & vacations (4%), Energy & utilities (4%), Home tech (4%), Streaming subscriptions (3%), Live entertainment (2%), Eating out (1%)

Additionally, the majority of Canadians have already made/plan to make big one-time purchases like phones, furniture, cars, etc,.

%

Have made or plan to make a a big one time purchase

- Phone 14%

- Furniture 13%

- Car 12%

- Other kitchen appliances 11%

- TV 9%

- Fridge 9%

- Laptop 6%

- Video game consoles 4%

- Tablet 4%

Products that Canadians wished they could have stocked up on 3-months ago

When asked what they wish they’d stocked up on three months ago, Canadians most often pointed to household essentials like groceries and cleaning supplies, followed by bigger-ticket items such as electronics and furniture. Still, a portion of respondents said they had no such regrets, feeling no need to stock up at all.

Household Essentials

I wish that I stocked up on more freezer items (meat, bread), and dried fruits and nuts. We’ve recently switched household cleaning products and body care stuff, so I’m just trying to stock up when it’s on sale

F, 65, Alberta

Laundry detergent, paper towels and snacks/food I have noticed a price increase in these. There are many other products such as bread and milk, oh yes, coffee cream too that have increased in price. I cannot understand why!

Other Items

I’d have replaced my very defective and lumbering phone with battery issues before the price of electronics rose

I would have maybe I would have bought the furniture that I needed and thought I would wait for the Spring. Now I won’t be buying anything for the the house for the foreseeable future

We will need a new car soon. I’ve been putting it off, but now I think we might have been smarter to get it several months ago.

Don’t feel the need to stock up

No products. Nothing that I purchase is in short supply. Stocking up is not worth it in my opinion

M, 62, Ontario

None, I don’t need to stock up on anything, and I’m not short on anything

In the current economy, half of Canadians use both online and in-store channels to shop, while just 9% rely on online alone.

Channel Usage

%

Online only

%

In-store only

%

Both channels

Online Shopping Trends

Momentum in online shopping appears to be flattening — more people say they’re shopping online less often (32%) than more often (21%).

Changes in online shopping frequency

- Shopping online more often 21%

- Shopping online less often 32%

- Shopping online the same amount 47%

Stores shopped at online most often

Categories shopped for most often online

Clothing & Footwear

Groceries

Household Supplies

Personal Care Items

Clothes. Because it’s just easier to get it delivered instead of going to the mall. I’m also able to compare prices and style quickly and easily.

Groceries because you can quickly compare prices at different stores

Household items like Kleenex boxes because I can find the cheapest price and I want to have conscience of not going to places like Walmart.

Skin care items. Enticing ads are sucking me in, often against my own better judgment.

Instore Shopping Trends

While most Canadians are shopping in-store about as often as they used to (65%), a small but notable segment (20%) report shopping in-store more frequently — outpacing the 15% who say they’re going less.

Changes in instore shopping frequency

- Shopping instore more often 20%

- Shopping instore less often 15%

- Shopping instore the same amount 65%

Stores shopped at instore most often

Local Stores

More than 4 in 5 Canadians feel that it is important to buy products that are 'Made in Canada' and are willing to pay more for it.

Importance of shopping for products made in Canada vs internationally

%

Very important

%

Somewhat important

%

Not very important

%

Not at all important

Categories Canadians want to purchase locally made

(among those for whom it is very/somewhat important to buy products that are made in Canada)

Groceries

%

Household supplies

%

Eating out

%

Alcoholic beverages

%

Personal care items

%

Energy & utilities

%

Travel & vacations

%

Healthcare & medical expenses

%

Other categories: Beauty & grooming products (43%), Finances & bills (42%), Clothing & footwear (40%), Transportation (35%), Tools/Home improvement (34%), Live entertainment (26%), Appliances (23%), Streaming subscriptions (17%), Baby/childcare products (15%), Personal electronics (15%), Home tech (15%)

Likelihood of spending more on products that are produced in Canada

%

Definitely willing to spend more

%

Probably willing to spend more

%

Probably not willing to spend more

%

Definitely not willing to spend more

Reasons for wanting to shop local or for ‘Made in Canada’ products

intent is to support the economy, local businesses and take a stand against unfavorable US policies

To support/protect the Canadian economy

I work hard to ensure I buy a Canadian to show my support for all things Canadian. I am a proud Indigenous Canadian who shows my support by buying everything Canadian. We should support our own economy before we support any other countries

It is important because of the current political landscape which threatens Canadians’ current way of life

To support local businesses

We need to support our own businesses with the current trade war. I refuse to support American businesses while the American president launches an unnecessary trade war and continually threatens our sovereignty

F, 57, Ontario

We need to be doing everything we can to support local/Canadian business. I’ve always had this mindset but it’s even more critical now

To take a stand against US policies

Given the annexation threats from the United States, the sentiment is more so to make sure I don’t buy anything American. If I can support local and Canadian businesses as a result of that, I see it as a win-win.

M, 68, Ontario

I think its really important at least symbolically to show that Canadians are going to stand up to the global threats.

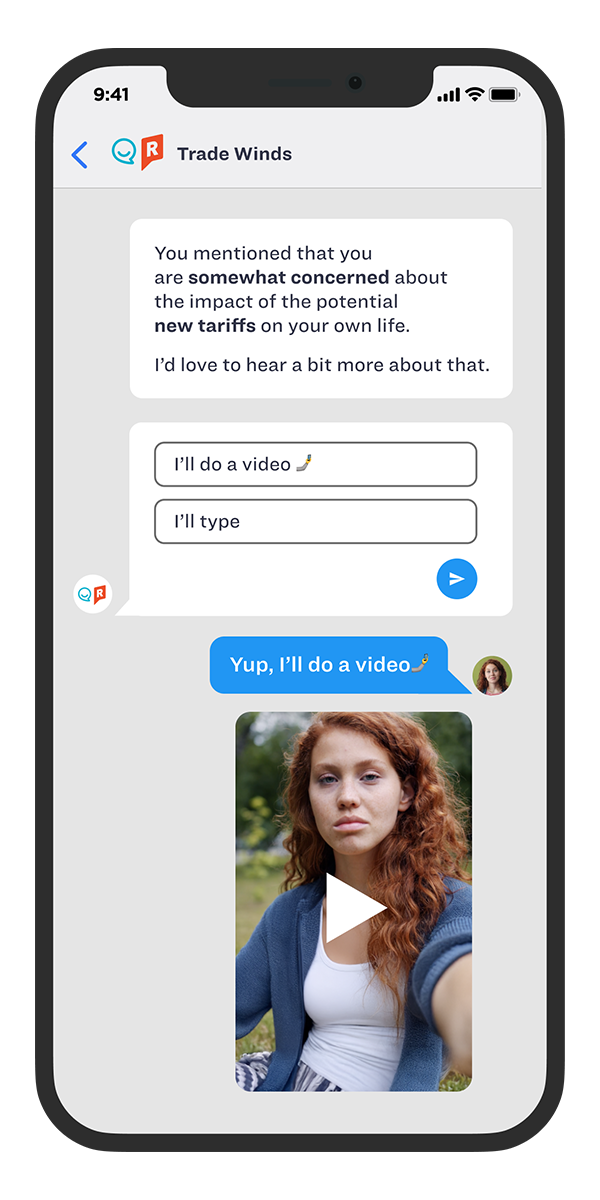

A word on our approach...

Fine Print:

A Nationally Representative Angus Reid Group Sample

Sample Size: n= 308 Canadians aged 18+ years old

Fieldwork dates: May 2-7, 2025

Mobile Chat

Coming Soon:

Over the next several months, we’ll be diving deeper into how tariffs and economic uncertainty are shaping everyday life. From grocery shopping habits and travel plans to the impact on media consumption, personal wellness, big-ticket purchases, and budgeting strategies — we’ll explore it all. We’ll also cover shifting consumer trust in brands and retailers, impulse spending trends, and how special occasions and summer holidays are being affected.

Stay tuned for fresh insights!

Curious to know more?

Email marketing@reach3insights.com or

use the Contact button below.

www.reach3insights.com

info@reach3insights.com // SMS: (833) 4Reach3 // Phone: (833) 4Reach3