Understanding the Impact of Tariffs on Shopping Behaviors

June 2025

Brought to you by:

Most Americans remain uneasy, expressing concern about what the future holds amid ongoing economic and trade policy uncertainty.

%

of Americans Feeling Negative About Future -

vs 75% in late April

Pessimistic

14%

vs 17% in late April

Stressed

13%

vs 14% in late April

Frustrated

14%

vs 13% in late April

Anxious

9%

vs 10% in late April

Consumer sentiment has remained relatively stable compared to late April, even as U.S. trade policy tensions ease — but that stability reflects a continued low level of optimism about both the general future and personal finances.

Level of optimism about the future

- 8-10 (vs 20% in late April) 16%

- 5-7 (vs 30% in late April) 35%

- 1-4 (vs 50% in late April) 49%

Level of optimism about financial future

- 8-10 (vs 18% in late April) 17%

- 5-7 (vs 41% in late April) 37%

- 1-4 (vs 41% in late April) 46%

*10 being very optimistic on the scale

Nearly half of consumers (49%) see stocking up on essentials as important — a signal of continued caution in how people plan for uncertainty. Over a third (35%) have already acted on this concern, while 43% are still considering it, suggesting stocking behaviors may continue to build.

%

Feel as though stocking up is essential / somewhat important

Approach to stocking up

- Have stocked up 35%

- Are considering stocking up 43%

- Are not considering it 22%

Categories stocked up / considering stocking up

Among those stocking up or considering it, the focus is clearly on daily-use categories — groceries (76%), household supplies (70%), and personal care items (59%) are leading the list. Categories like alcoholic beverages, appliances and home technology remain lower priority for now

- Groceries 76%

- Household supplies 70%

- Personal care items 59%

- Beauty / grooming products and services 19%

- Healthcare items 18%

- Clothing/footwear 17%

- Personal electronics 12%

- Tools / home improvement items / construction materials 11%

- Alcoholic beverages 9%

- Appliances 7%

- Home tech 6%

Other Items: Transportation (6%), Energy & utilities (6%), Baby/childcare products (6%), Eating out (6%), Travel/vacations (5%), Streaming subscriptions (5%), Live entertainment (1%)

Nearly half of Americans (48%) have made or plan to make a significant one-time purchase, such as a phone, laptop, or appliance.

%

Have made or plan to make a a big one time purchase

- Phone 16%

- Laptop 12%

- Other kitchen appliances 11%

- Furniture 11%

- Car 11%

- TV 9%

- Video game consoles 8%

- Tablet 5%

- Fridge 4%

Products that Americans wished they could have stocked up on 3-months ago

When asked what they wish they stocked up on, many Americans think of household essentials – including groceries, gas, toilet paper – while some also think of personal tech, and clothing.

Household Essentials

I definitely wish I would have stocked up on paper products. They are getting a little more expensive. Toilet paper, paper towels, just like printer paper, I’ve noticed getting more expensive. Also like spices are getting more expensive. I kind of wish I would have stocked up on those a little more. Good thing is, olive oil is going down. So that’s a good thing.

M, 36, Midwest

Toilet paper, paper towels. mainly paper products. Soap, face wash, body wash, moisturizer. Batteries, cat food, etc. These are all necessities that are constantly being used in my household and needed every couple weeks.

Other Items

I wish I had the money to replace my aging phone. With looming tech tariffs, I imagine its only going to be harder to replace tech gadgets as they age. Currently I’m having to pick and choose my most pressing needs to upgrade before they become wholly unaffordable.

Clothing is usually what comes to mind. I typically will wait for spring to buy whatever new items I need for the summer, but now I feel like I will just have to stick it out.

I wish that I had bought a video game console a few years ago because due to tariffs they have increased in price by over $100. I also wish that I would have purchased more computer equipment for my prosumer work, like hard drives for video storage and archival. As those are already significantly more expensive as well.

Don’t feel the need to stock up

I would not go back and stock up. I don’t know what stuff would be worth stocking up on. It reminds me of people overstocking on toilet paper during covid.

F, 62, Midwest

I don’t wish that I’d stocked up on any products. I don’t see a need for it at this time. I’m not aware of any shortages.

The current economic scenario is also impacting shopping behaviors, more so online than in-store, with online shopping frequency changing for 3 in 5 Americans

Channel Usage

%

Online only

%

In-store only

%

Both channels

Online Shopping Trends

Momentum in online shopping appears to be rising — more people say they’re shopping online more often (35%) than less often (23%).

Changes in online shopping frequency

- Shopping online more often 35%

- Shopping online less often 23%

- Shopping online the same amount 42%

Stores shopped at online most often

Categories shopped for most often online

Groceries & HH Supplies

Clothing & Footwear

Pet Supplies

Household essentials because there are more on discount now.

Clothing, because the selection in stores is so limited and many online vendors have free returns.

I buy pet food online more because it is generally cheaper than in store and it is heavy to carry so I would rather have it delivered.

Instore Shopping Trends

While most Americans are shopping in-store about as often as they used to (64%), a small but notable segment (19%) report shopping in-store more frequently.

Changes in instore shopping frequency

- Shopping instore more often 19%

- Shopping instore less often 17%

- Shopping instore the same amount 64%

Stores shopped at instore most often

More than half of Americans feel it is important to buy products that are Made in USA and are willing to pay more for it.

Importance of shopping for products ‘Made in the US’ vs internationally

%

Very important

%

Somewhat important

%

Not very important

%

Not at all important

Categories Americans want to purchase locally made

(among those for whom it is very/somewhat important to buy products that are made in America)

Groceries

%

Household supplies

%

Healthcare & medical expenses

%

Personal care items

%

Clothing & footwear

%

Energy & utilities

%

Eating out

%

Transportation

%

Other categories: Tools & home improvement (37%), Beauty & grooming products (35%), Appliances (27%), Personal electronics (26%), Streaming subscriptions (25%), Travel & vacations (24%), Alcoholic beverages (23%), Home tech (22%), Live entertainment (21%), Baby & childcare products (19%)

Likelihood of spending more on products that are produced in the USA

%

Definitely willing to spend more

%

Probably willing to spend more

%

Probably not willing to spend more

%

Definitely not willing to spend more

Reasons for wanting to shop local or for ‘Made in US’ products

The US consumer intention is to support local jobs, their fellow Americans, and in turn the economy.

Supporting the American job market/ helping the economy

The bottom line for me is that buying American-made products helps keep more jobs at home rather than sending those jobs to a place like China. I would pay more for American-made if I had too.

F, 72, South

It’s good to support American companies for American jobs instead of outsourcing everything.

To support fellow Americans

I am patriotic. I love America. I would rather support and do business with Americans and have my money end up in the hands of Americans than someone from any other country regardless of how I feel about that country.

I love my country and I’m willing to spend extra to support my fellow Americans.

Fresh produce & baked goods

I bought locally produced produce, which was more expensive than foods from other countries, but it was worth it to support our local farmers.

I like to buy locally made baked goods, because I know it supports people in my community!

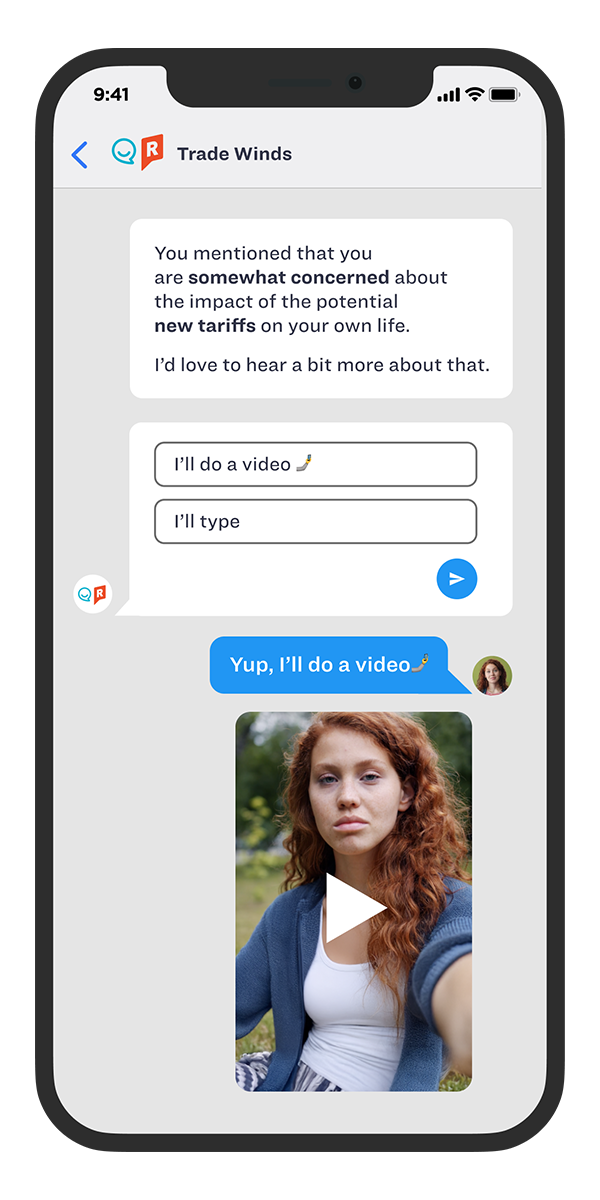

A word on our approach...

Fine Print:

A Nationally Representative Angus Reid Group Sample

Sample Size: n= 312 Americans aged 18+ years old

Fieldwork dates: May 2-7, 2025

Mobile Chat

Coming Soon:

Over the next several months, we’ll be diving deeper into how tariffs and economic uncertainty are shaping everyday life. From grocery shopping habits and travel plans to the impact on media consumption, personal wellness, big-ticket purchases, and budgeting strategies — we’ll explore it all. We’ll also cover shifting consumer trust in brands and retailers, impulse spending trends, and how special occasions and summer holidays are being affected.

Stay tuned for fresh insights!

Curious to know more?

Email marketing@reach3insights.com or

use the Contact button below.

www.reach3insights.com

info@reach3insights.com // SMS: (833) 4Reach3 // Phone: (833) 4Reach3