Understanding The Impact of Tariffs on Entertainment Habits

August 2025

Brought to you by:

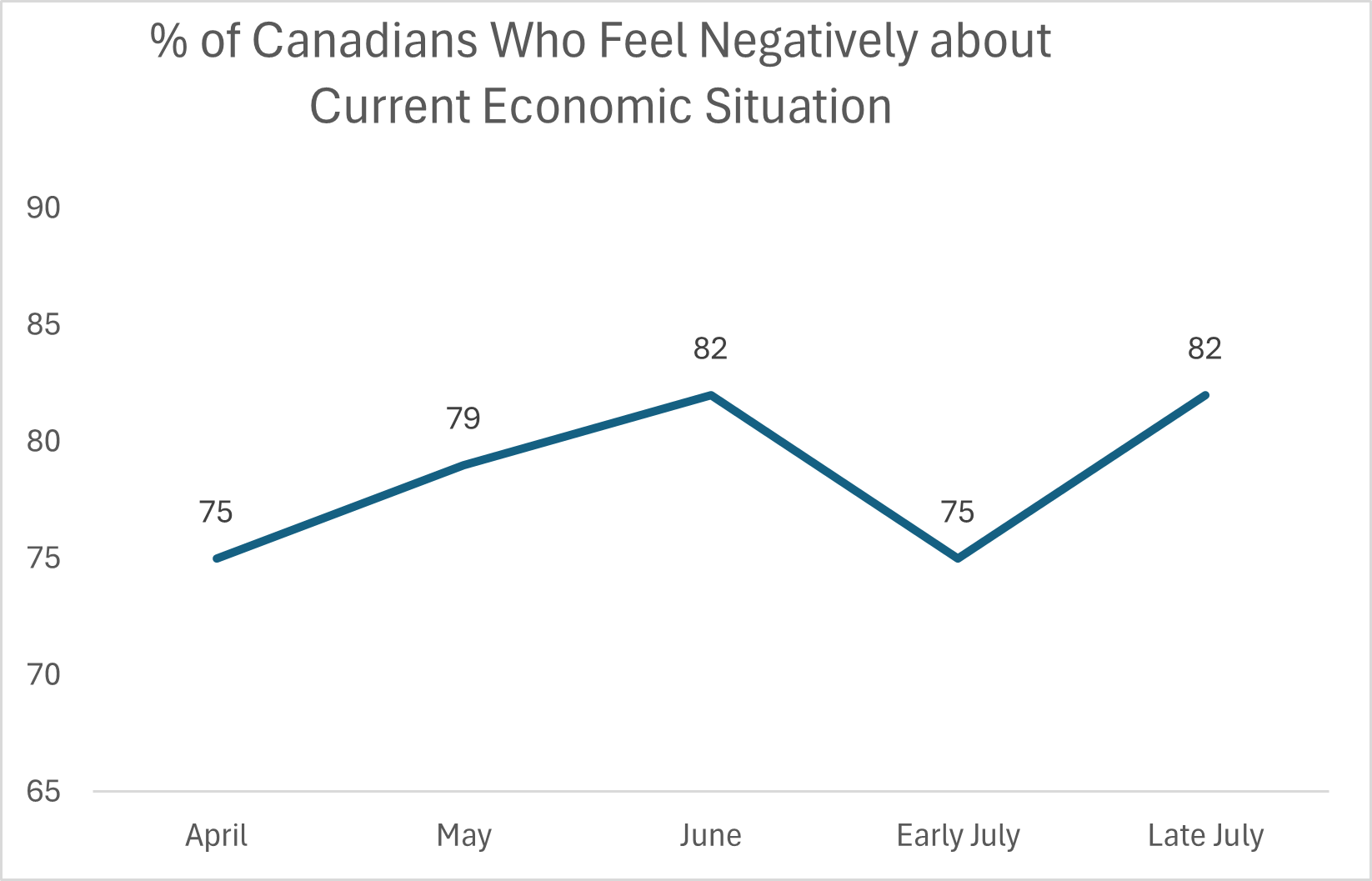

Most Canadians continue to feel negatively about the current economic climate, with feelings of frustration, pessimism, stress, and anxiety being most widely felt.

Perceptions of Current Economic Situation

%

of Canadians feel negatively about the current economic situation

vs 75% in early July

Top Emotions Around Current Economic Situation

Frustration

18%

vs 11% in early July

Pessimism

14%

unchanged vs early July

Stress

13%

vs 11% in early July

Anxiety

12%

vs 15% in early July

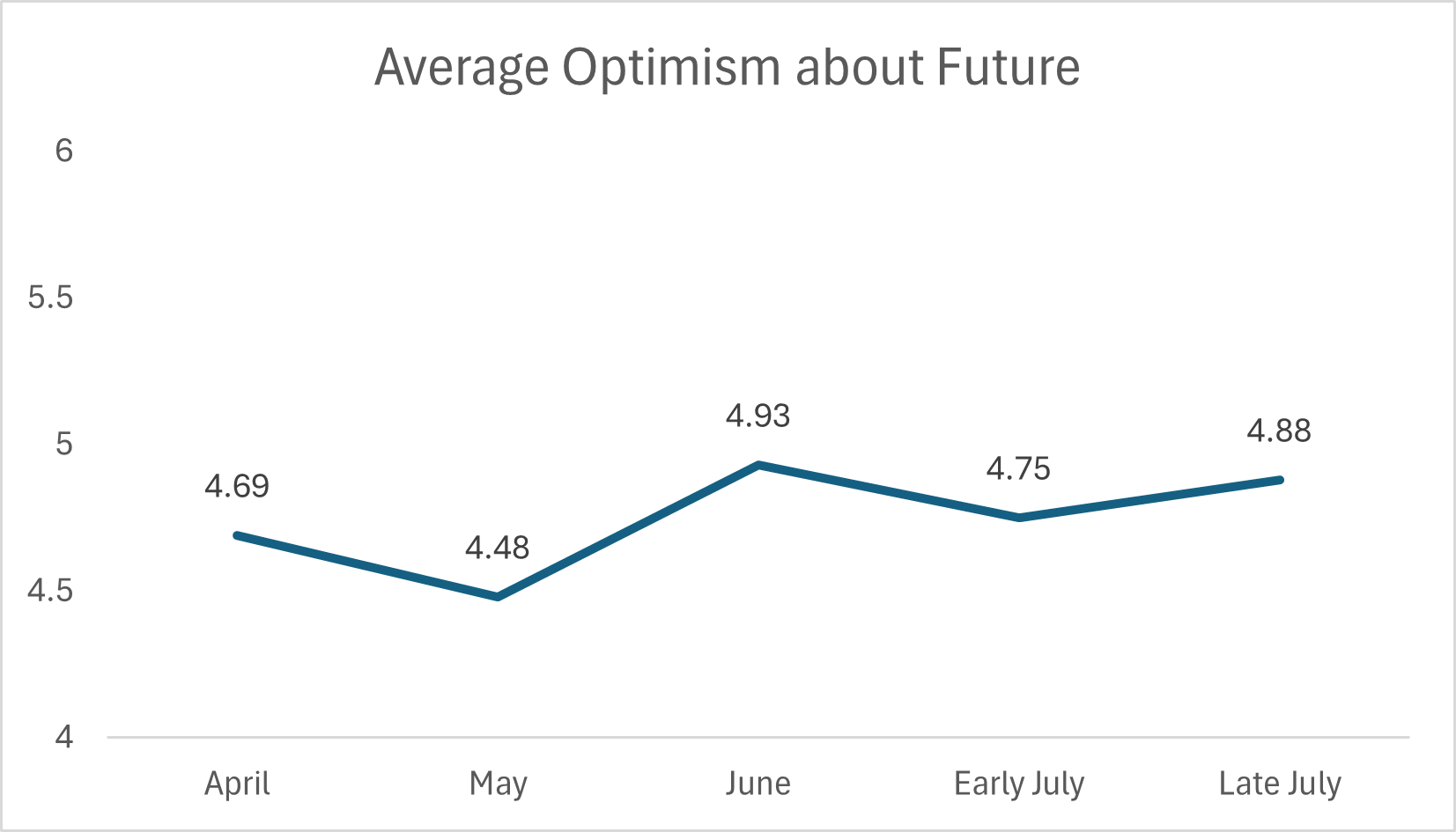

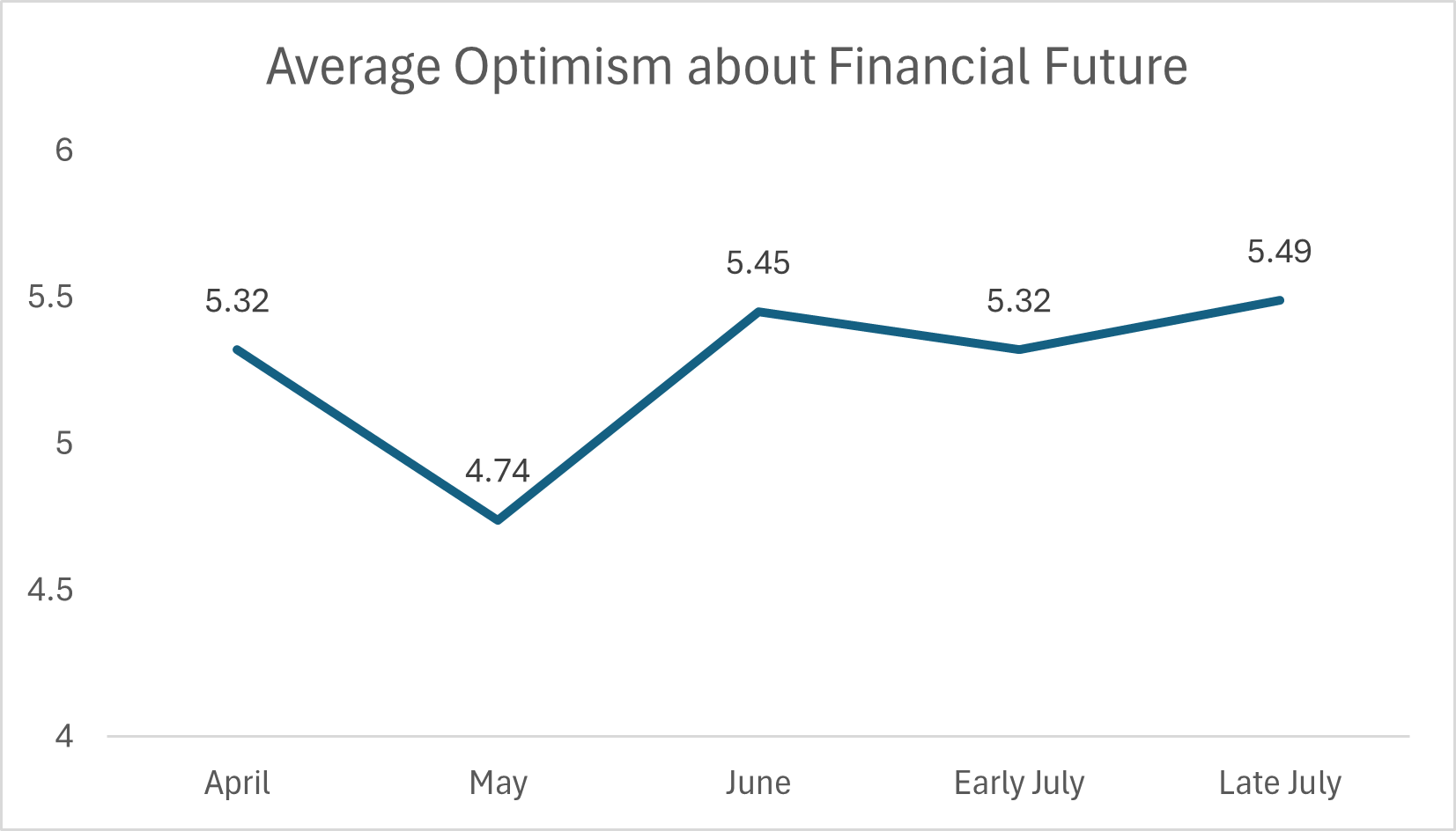

As tariffs begin to take effect, Canadians’ optimism about their financial future has increased since early July.

Level of Optimism about the Future

- 8-10 (vs 12% in early July) 10%

- 5-7 (vs 46% in early July) 45%

- 1-4 (vs 42% in early July) 45%

*10 being very optimistic on the scale

Level of Optimism about Financial Future

- 8-10 (unchanged vs early July) 20%

- 5-7 (vs 57% in early July) 49%

- 1-4 (vs 23% in early July) 31%

4 in 5 Canadians say economic policies are increasing their cost of living, leading to about half feeling uncertainty about their personal finances.

Impact Towards Cost of Living

%

of Canadians feel that economic policies are impacting their personal cost of living

%

of Canadians feel uncertain about their personal finances

Alongside shifts in financial confidence, Canadians are changing how they engage with entertainment and media.

One-third of Canadians are cutting back spend on entertainment options – driven by rising prices for their everyday essentials.

%

of Canadians have decreased their total spending on entertainment options

Primary Reasons for Decrease in Spend (among those who report that they’ve decreased spending on enterainment)

- Prices for everyday essentials (groceries, gas, etc.) have gone up 62%

- I’ve had to cut back across the board, not just entertainment 39%

- Streaming, cable, or ticket prices have become too expensive 25%

- I only subscribe or attend when something really appeals to me 15%

Top Actions Taken to Reduce Costs (among those who report that they’ve decreased spending on enterainment)

- Reduced or stopped attending live events (concerts, sports, etc.) 57%

- Reduced or stopped going to movie theaters 57%

- Cancelled one or more streaming services 54%

- Subscribe to fewer services at the same time (rotating in and out) 40%

What’s Essential vs. Nice-to-Have in Entertainment Today

Internet service tops the list of essentials, while many put live events and movie theaters in the nice-to-have category.

Essential Entertainment

- Internet service 94%

- Music streaming 39%

- YouTube 37%

- At least one paid streaming service 35%

- Cable or satellite TV 27%

- Podcasts or audiobooks 25%

- Gaming (console, PC, mobile) 18%

- Free streaming apps with ads 14%

- Live events (e.g., concerts, sports, theater) 12%

- Movie theater experiences 8%

Nice-to-have Entertainment

- Live events (e.g., concerts, sports, theater) 49%

- YouTube 44%

- Free streaming apps with ads 43%

- Movie theater experiences 43%

- At least one paid streaming service 41%

- Music streaming 33%

- Podcasts or audiobooks 30%

- Gaming (console, PC, mobile) 27%

- Cable or satellite TV 27%

- Internet service 5%

One person’s must-have is another’s nice-to-have. Platforms like YouTube and streaming services show up on both lists, revealing just how differently Canadians define “essential” when it comes to entertainment.

Most Essential Streaming Services

56%

30%

16%

13%

6%

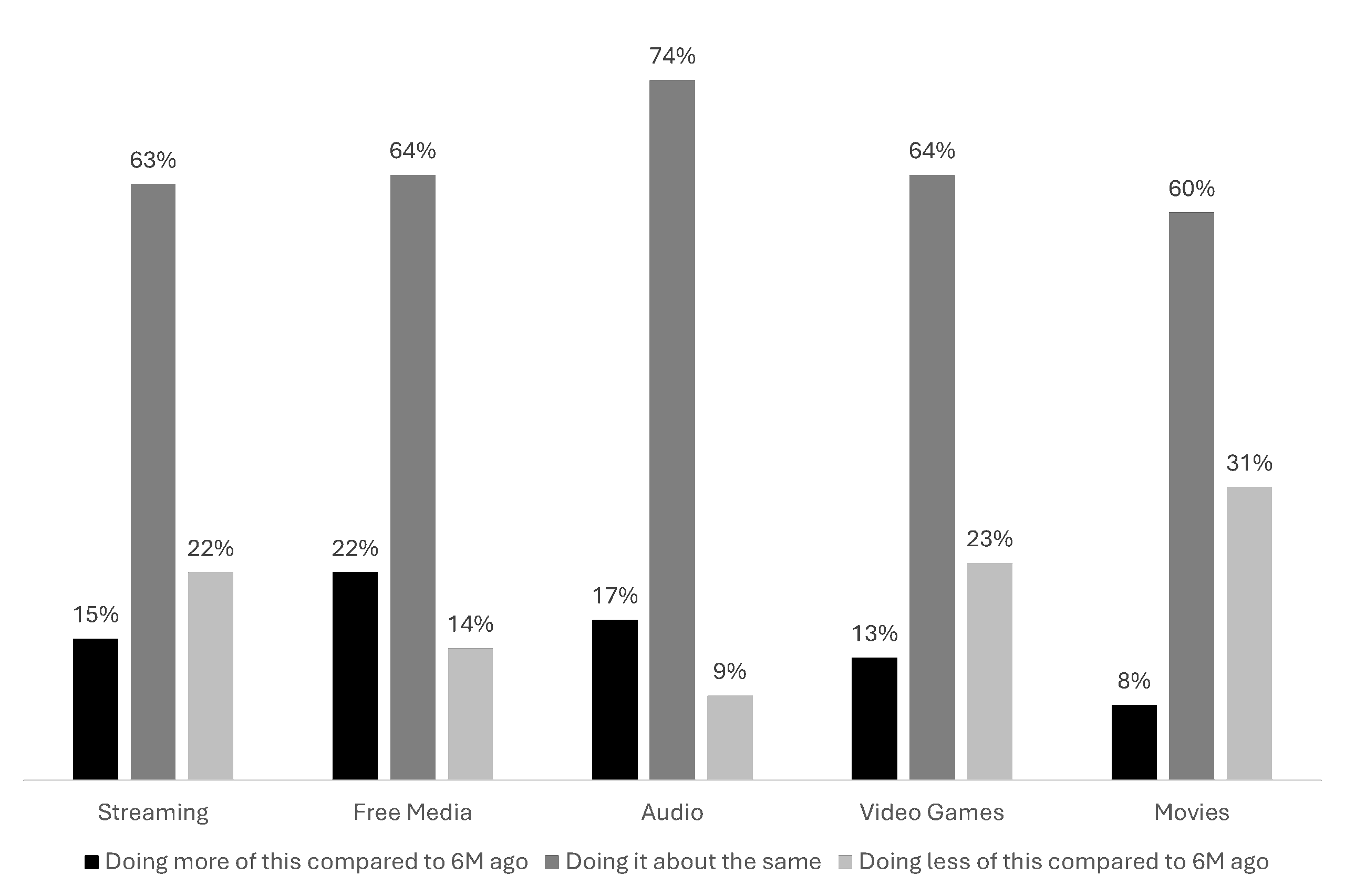

In the past few months, Canadians are mostly keep their entertainment routines steady, with movies seeing the biggest drop.

Recent Engagement with Entertainment Options

Almost 6 in 10 Canadians have adjusted their streaming habits in the past 6 months. Common changes include resubscribing based on that they want to watch, and switching to free or ad-supported services.

Changes in Streaming Habits (Past 6 Months)

- I cancel and resubscribe based on what I want to watch 27%

- I use more free or ad-supported services instead 19%

- I rotate services (I’m never subscribed to all of them at once) 15%

- I’ve switched to ad-supported tiers to save money 15%

- I only subscribe when a specific show or movie is available 10%

- I rely more on bundled deals (e.g., streaming services included with phone, internet) 10%

- I used to subscribe annually but now go month-to-month 4%

- No major changes 42%

Canadians show a balance between financial pressures and emotional values when it comes to entertainment. Some say it allows them to redirect energy to more meaningful things in life, while others feel they are missing out on shared cultural and social experiences.

F, 33, Ontario

M, 41, Atlantic

I don’t really feel like I’m missing out, I feel like I can actually get real-life things accomplished when I cut down on entertainment.

I do not feel like I am missing out because I can reorient myself to other hobbies and recreation or just spending time with friends and family.

It makes me sad because I go to events less because of the cost and I miss out on spending time with friends and enjoying these experiences.

I think what I miss most is the ability to unwind and disconnect. Entertainment helps me relax and recharge, and without it, things can start to feel a bit too routine.

Canadians are cancelling their subscription services because they are too expensive and aren't getting enough usage out of them.

Paid subscriptions are the most common way Canadians are accessing their entertainment content.

Current Access of Streaming Entertainment Conent

- Through paid subscriptions I manage directly 42%

- Mostly using free or ad-supported services 15%

- Through shared accounts from family or friends 11%

- Through bundles (e.g., streaming services bundled with phone, internet, credit card) 9%

- A mix of all of the above 17%

Canadians are using a mix of ad-free and ad-supported streaming services.

Current Access of Streaming Entertainment Content

67% Use

Among Users

25% Ad-free

73% Ad-supported

59% Use

Among Users

48% Ad-free

49% Ad-supported

35% Use

Among Users

61% Ad-free

32% Ad-supported

30% Use

Among Users

70% Ad-free

18% Ad-supported

16% Use

Among Users

Note: Ad-supported not offered

13% Use

Among Users

41% Ad-free

50% Ad-supported

Almost half of Canadians have cancelled or downgraded their subscriptions in the past 6 months because services are becoming too expensive and not being used enough to justify keeping the service.

%

of Canadians have cancelled or downgraded subscriptions in the past 6 months

Reasons for Cancelling or Downgrading Entertainment Subscriptions (among those who have cancelled or downgraded subscriptions in the past 6 months)

- Too expensive for what I was getting 60%

- I wasn’t using it enough 50%

- Nothing I wanted to watch 23%

- I rotate services and come back when needed 21%

- I only wanted it for one show or movie 20%

- I found something similar for free 5%

Ways to get Canadians to Return to Entertainment Options (among those who have cancelled or downgraded subscriptions in the past 6 months)

- Lower monthly pricing or better value tiers 67%

- A new show, movie, or event I really wanted to watch 37%

- Improved content overall 36%

- A change in my financial situation 35%

- Special offers, bundles, or promotions 21%

- Feeling more confident about the economy 16%

We cancelled Netflix, Disney and Amazon Prime because they are American services. We did this when Trump first announced tariffs.

When Trump is no longer president and stupid tariff war is resolved and when tech companies like Netflix and Facebook are taxed accordingly in Canada.

A word on our approach...

Fine Print:

A Nationally Representative Angus Reid Group Sample

Sample Size: n= 312 Canadians aged 18+ years old

Fieldwork dates: July 13-16, 2025

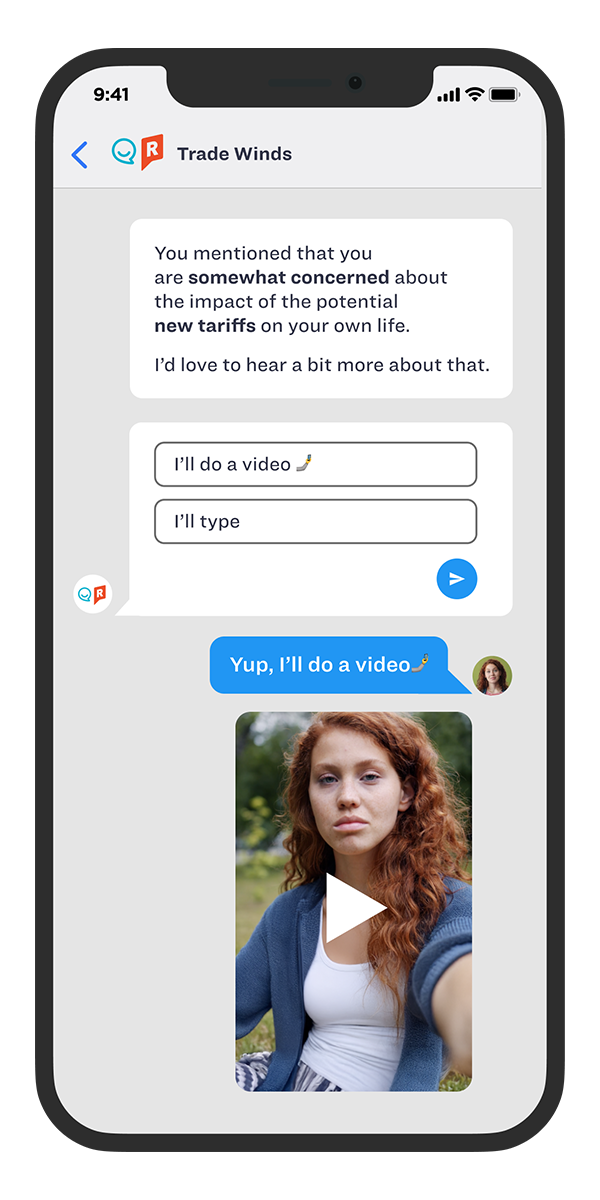

Mobile Chat

Coming Soon:

Over the next several months, we’ll be diving deeper into how tariffs and economic uncertainty are shaping everyday life. In our next update, we will be discussing how the impending tariffs on technology are affecting future purchases and understanding how financial outlooks are shifting.

Stay tuned for fresh insights!

Curious to know more?

Email marketing@reach3insights.com or

use the Contact button below.

www.reach3insights.com

info@reach3insights.com // SMS: (833) 4Reach3 // Phone: (833) 4Reach3