Understanding The Impact of Tariffs on Entertainment Habits

August 2025

Brought to you by:

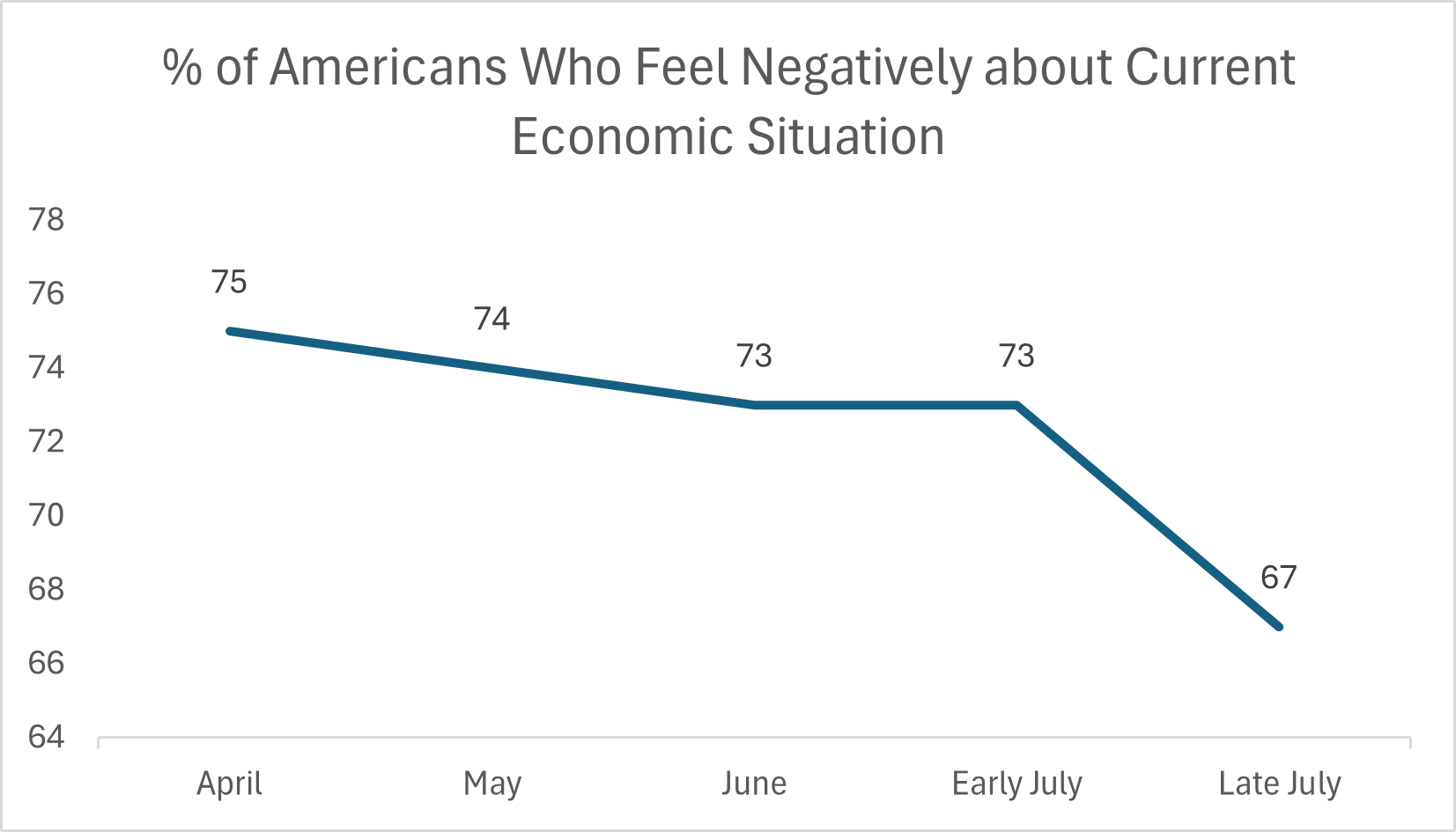

Sentiment around the economy is gradually rebounding, reaching its most optimistic point in months — though nearly 2 in 3 Americans still feel negative overall.

Perceptions of Current Economic Situation

%

of Americans feel negatively about the current economic situation

vs 73% in early July

Top Emotions Around Current Economic Situation

Pessimism

17%

vs 12% in early July

Anxiety

12%

vs 16% in early July

Frustration

10%

vs. 14% early July

Stress

10%

vs 16% in early July

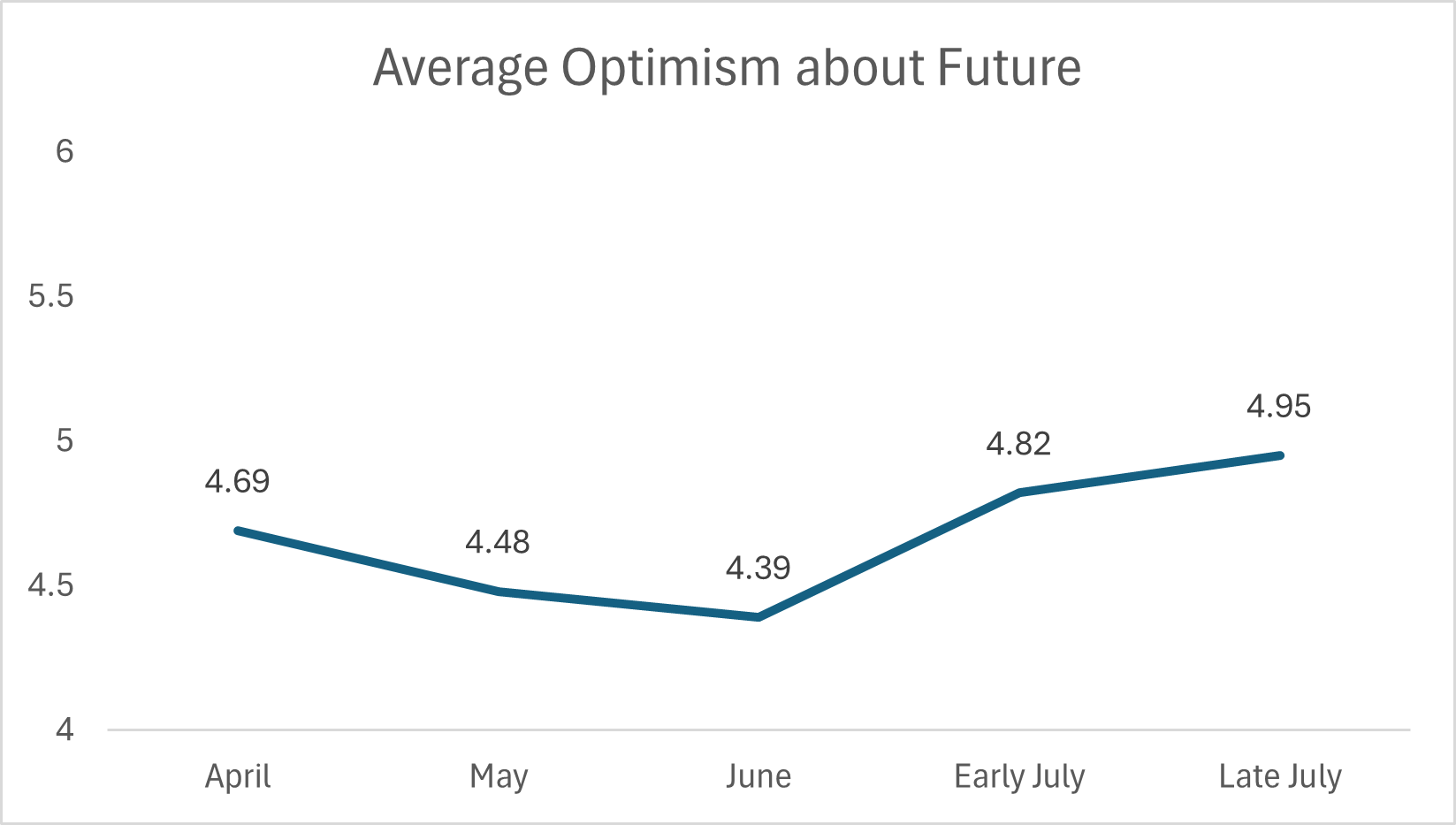

Overall optimism about the future has remained relatively stable compared to early July, though Americans are becoming more divided, with fewer feeling neutral.

Level of Optimism about the Future

- 8-10 (vs 18% in early July) 21%

- 5-7 (vs 38% in early July) 32%

- 1-4 (vs 44% in early July) 47%

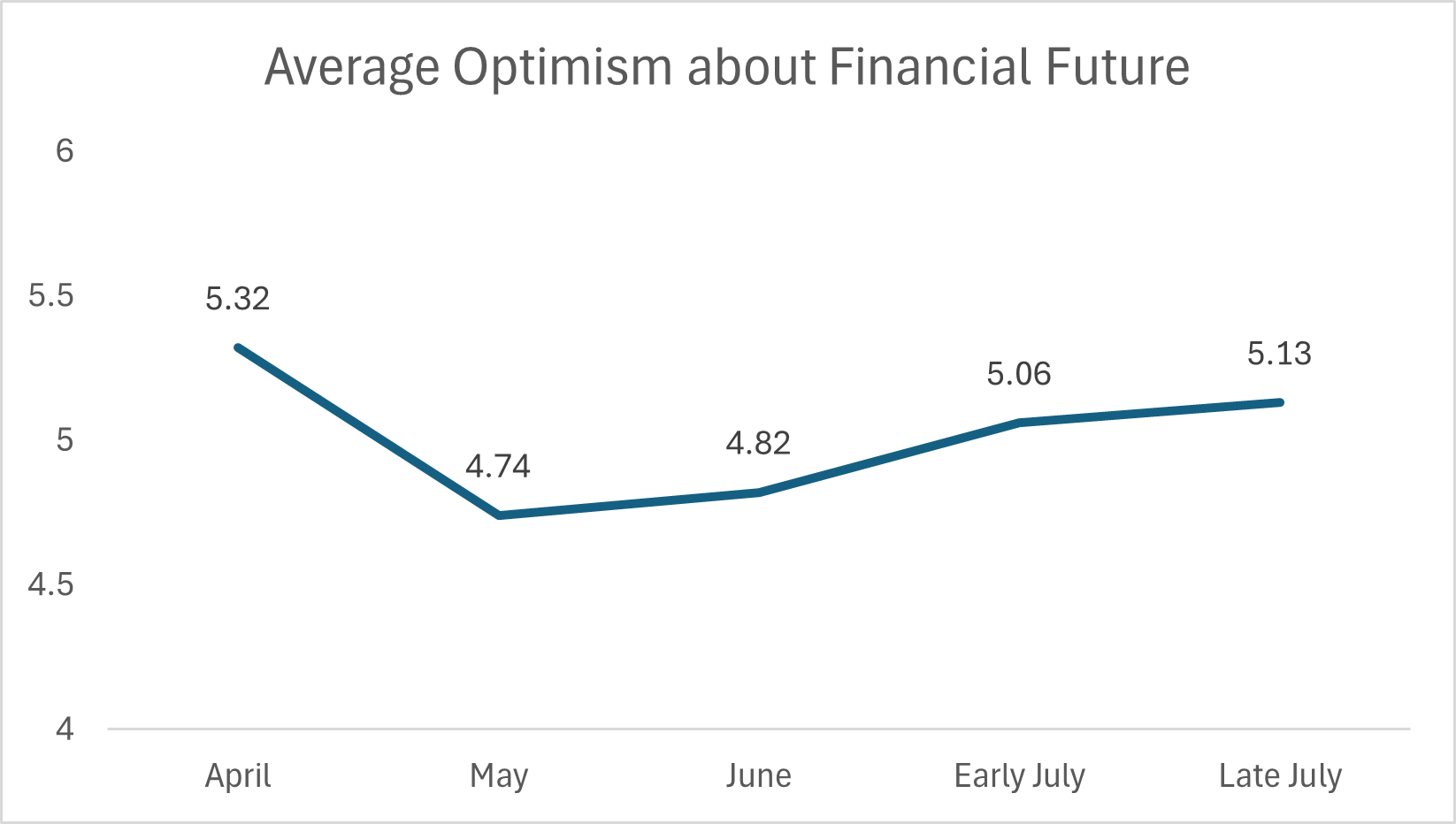

Level of Optimism about Financial Future

- 8-10 (vs 19% in early July) 18%

- 5-7 (vs 43% in early July) 44%

- 1-4 (vs 38% in early July) 37%

*10 being very optimistic on the scale

Americans are feeling more optimistic about both the future and their own finanical future than they have in previous months.

Most Americans say economic policies are driving up their cost of living, and nearly half feel uncertain about their personal finances as a result.

Impact Towards Cost of Living

%

of Americans feel that economic policies are impacting their personal cost of living

%

of Americans feel uncertain about their personal finances

Alongside shifts in financial confidence, Americans are also changing how they engage with entertainment and media.

Nearly 4 in 10 Americans have cut back on entertainment spending — driven by rising essential costs and managed by canceling services and turning to free content.

%

of Americans have decreased their total spending on entertainment options

Primary Reasons for Decrease in Spend (among those who report that they’ve decreased spending on entertainment)

- Prices for everyday essentials (groceries, gas, etc.) have gone up 62%

- I’ve had to cut back across the board, not just entertainment 44%

- Streaming, cable, or ticket prices have become too expensive 18%

- I’m not seeing enough content I want to pay for 15%

Top Actions Taken to Reduce Costs (among those who report that they’ve decreased spending on enterainment)

- Cancelled one or more streaming services 46%

- Reduced or stopped going to movie theaters 43%

- Reduced or stopped attending live events (concerts, sports, etc.) 39%

- Used more free apps or content with ads 36%

What’s Essential vs. Nice-to-Have in Entertainment Today

Internet service tops the list of essentials, while many put live events and movie theaters in the nice-to-have category.

Essential Entertainment

- Internet service 86%

- YouTube 36%

- At least one paid streaming service 35%

- Music streaming 30%

- Free streaming apps with ads 30%

- Cable or satellite TV 23%

- Gaming (console, PC, mobile) 19%

- Podcasts or audiobooks 15%

- Live events (e.g., concerts, sports, theater) 9%

- Movie theater experiences 6%

Nice-to-have Entertainment

- Free streaming apps with ads 46%

- YouTube 44%

- Movie theater experiences 42%

- At least one paid streaming service 41%

- Music streaming 41%

- Live events (e.g., concerts, sports, theater) 39%

- Podcasts or audiobooks 31%

- Gaming (console, PC, mobile) 30%

- Cable or satellite TV 21%

- Internet service 11%

One person’s must-have is another’s nice-to-have. Platforms like YouTube and streaming services show up on both lists, revealing just how differently Americans define “essential” when it comes to entertainment.

Most Essential Streaming Services

68%

33%

25%

13%

9%

8%

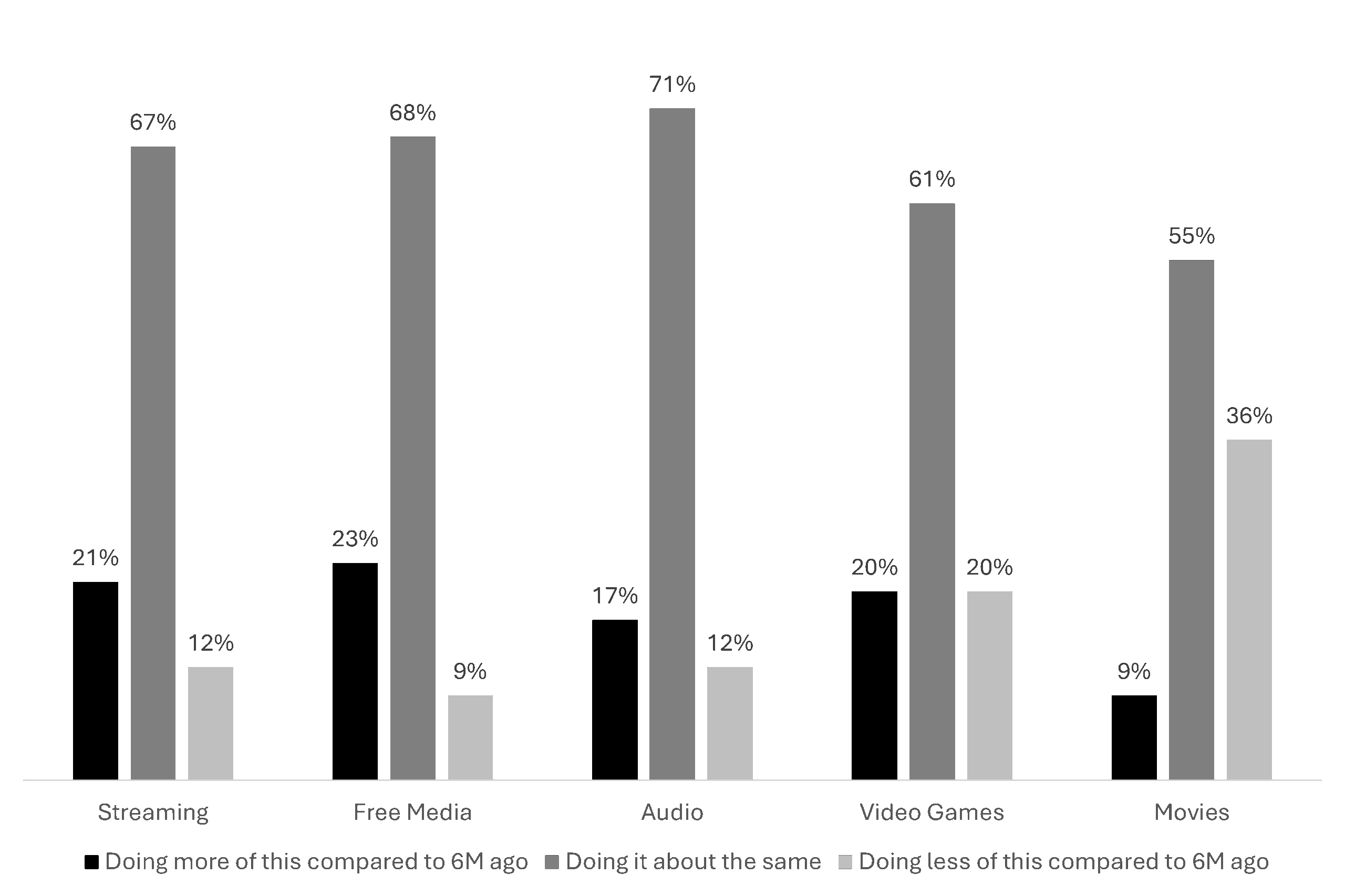

In the past few months, Americans are mostly sticking to their entertainment habits, with movies seeing the steepest decline.

Recent Engagement with Entertainment Options

About 6 in 10 Americans have adjusted their streaming habits in the past 6 months. Common changes include using free platforms, switching plans, or subscribing only when specific content is available.

Changes in Streaming Habits (Past 6 Months)

- I use more free or ad-supported services instead 32%

- I’ve switched to ad-supported tiers to save money 24%

- I cancel and resubscribe based on what I want to watch 21%

- I rely more on bundled deals (e.g., streaming services included with phone, internet) 16%

- I only subscribe when a specific show or movie is available 14%

- I rotate services (I’m never subscribed to all of them at once) 12%

- I used to subscribe annually but now go month-to-month 5%

- No major changes 40%

Many Americans feel a loss of social connection when they are unable to keep up with their shows. It is an important outlet for relaxation, and its absence is felt in daily life. Though some say it is easier to go without entertainment when the quality is lacking.

M, 31, Midwest

F, 35, West

I feel that I’m missing out on a few things. Firstly, connecting with other’s by being able to discuss shows, that I no longer have access to (no longer have a certain streaming service). I also lose a form of relaxation.

It would be so hard to cut back. Entertainment is such a big part of conversation with others and really the easiest way to unwind and relax throughout the day. Id really feel like I was missing out.

I don’t feel like I am missing out on anything by cutting back on entertainment because the shows and movies being made are no longer are high enough quality to matter.

Well I pretty much use entertainment as my means to keep my sanity when things are going hectic as my release. If I cut back on entertainment I’d be missing that release so to speak.

Americans are switching to cheaper, ad-supported tiers of their streaming services in efforts to save on costs.

Paid subscriptions remain the most common access point, with 42% managing their own accounts — but many also lean on free tiers, shared logins, or bundled services.

Current Access of Streaming Entertainment Content

- Through paid subscriptions I manage directly 42%

- Mostly using free or ad-supported services 22%

- Through shared accounts from family or friends 11%

- Through bundles (e.g., streaming services bundled with phone, internet, credit card) 9%

- A mix of all of the above 13%

Many Americans are still using streaming services, with many opting to to use the ad-supported version.

Most Used Streaming Services & Service Plan

66% of Americans Use

Among Users

20% Ad-free

73% Ad-supported

60% of Americans Use

Among Users

46% Ad-free

50% Ad-supported

45% of Americans Use

Among Users

26% Ad-free

72% Ad-supported

42% of Americans Use

Among Users

38% Ad-free

60% Ad-supported

35% of Americans Use

Among Users

30% Ad-free

67% Ad-supported

34% of Americans Use

Among Users

27% Ad-free

71% Ad-supported

33% of Americans Use

Among Users

50% Ad-free

49% Ad-supported

15% of Americans Use

Among Users

Note: Ad-supported not offered

Nearly half of Americans have cancelled or downgraded a subscription in the last 6 months. Most say it just wasn’t worth the price — either too expensive or not used enough. What could bring them back? Cheaper plans, better finances, or something they really want to watch.

%

of Americans have cancelled or downgraded subscriptions in the past 6 months

Reasons for Cancelling or Downgrading Entertainment Subscriptions (among those who have cancelled or downgraded subscriptions in the past 6 months)

- Too expensive for what I was getting 65%

- I wasn’t using it enough 51%

- Nothing I wanted to watch 23%

- I only wanted it for one show or movie 21%

- I rotate services and come back when needed 16%

- I found something similar for free 8%

Ways to get Americans to Return to Entertainment Options (among those who have cancelled or downgraded subscriptions in the past 6 months)

- Lower monthly pricing or better value tiers 69%

- A change in my financial situation 46%

- A new show, movie, or event I really want to watch 35%

- Special offers, bundles, or promotions 29%

- Feeling more confident about the economy 29%

- Improved content overall 25%

Like with Amazon Prime, I only get during the NFL season and then when the season is over, I cancel because I don’t use it much after the season ends.

Nothing would get me to come back, I’ve found free ways to stream what I want to watch. I don’t see any reason to pay for anything anymore.

A word on our approach...

Fine Print:

A Nationally Representative Angus Reid Group Sample

Sample Size: n= 312 Americans aged 18+ years old

Fieldwork dates: July 13-16, 2025

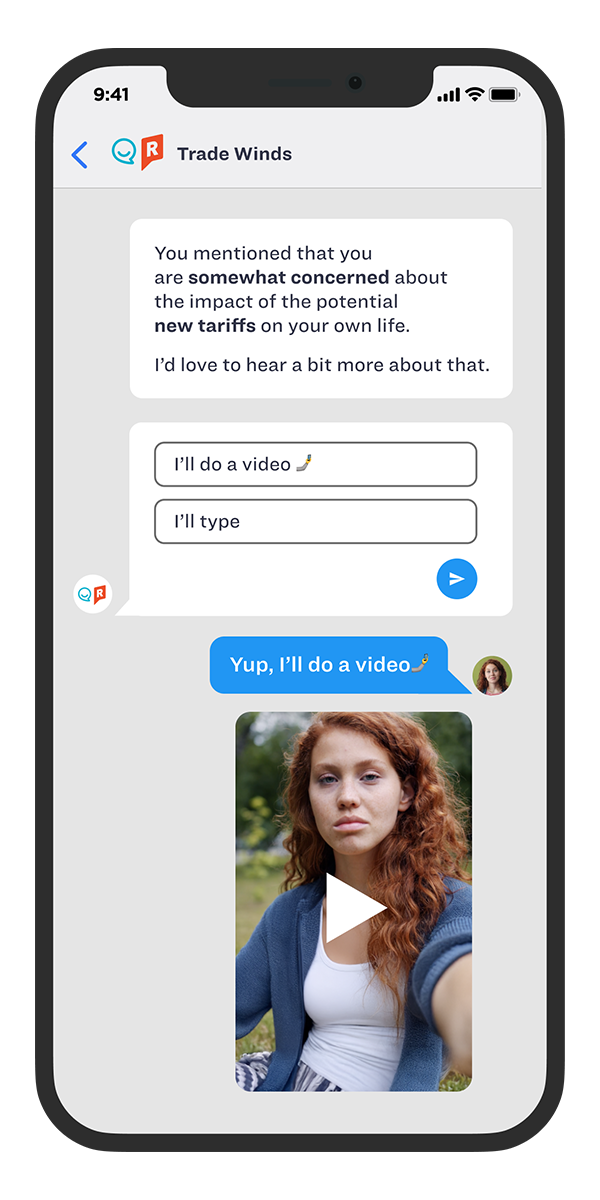

Mobile Chat

Coming Soon:

Over the next several months, we’ll be diving deeper into how tariffs and economic uncertainty are shaping everyday life. In our next update, we will be discussing how the impending tariffs on technology are affecting future purchases and understanding how financial outlooks are shifting.

Stay tuned for fresh insights!

Curious to know more?

Email marketing@reach3insights.com or

use the Contact button below.

www.reach3insights.com

info@reach3insights.com // SMS: (833) 4Reach3 // Phone: (833) 4Reach3