Understanding The Impact of Tariffs on

Holiday Spending

November 2025

Brought to you by:

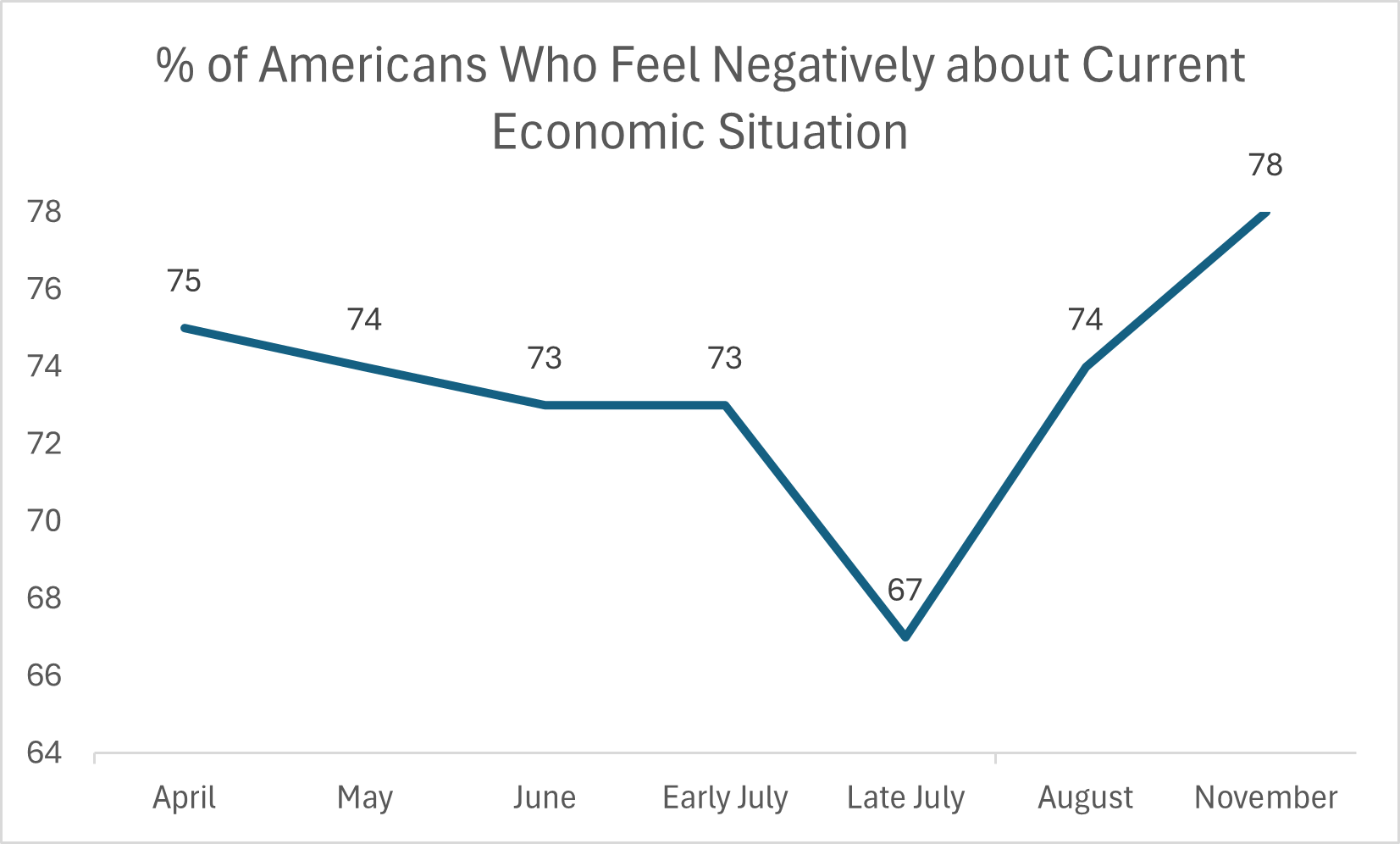

Sentiments around the current economic situation are increasingly negative, with Americans feeling stressed, pessimistic and frustrated.

Perceptions of Current Economic Situation

%

of Americans feel negatively about the current economic situation

vs 74% in August

Top Emotions Around Current Economic Situation

Americans continue to feel negatively – with feelings of stress increasing slightly (vs August) and feelings of pessimism and frustration remaining consistently high.

Stressed

18%

vs 16% in August

Pessimistic

17%

unchanged since August

Frustrated

16%

unchanged since August

Optimistic

10%

vs 7% in August

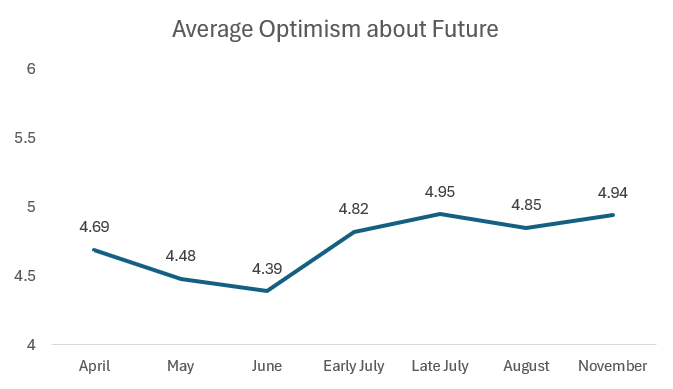

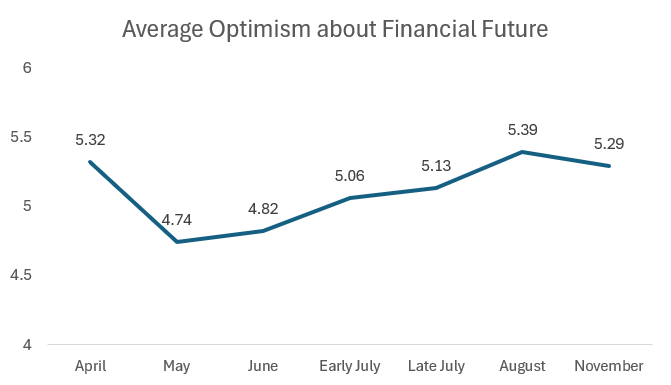

Overall optimism has stayed steady (vs August), while financial optimism has dipped slightly (albeit remaining higher than earlier in the year).

Level of Optimism about the Future

- 8-10 (vs 20% in August) 19%

- 4-7 (vs 47% August) 49%

- 1-3 (vs 34% in August) 33%

*10 being very optimistic on the scale

Level of Optimism about Financial Future

- 8-10 (vs 22% in August) 23%

- 4-7 (vs. 53% in August) 53%

- 1-3 (unchanged since August) 24%

Despite ongoing economic unease, one in three people feel excited for the holiday season, while feelings of anxiety or dread are less common.

Feelings Towards This Holiday Season

- Excited and looking forward to it 37%

- Neutral – I feel neither positive nor negative 33%

- Anxious or stressed about it 17%

- I’m dreading it / feeling down 8%

- Not sure 4%

Holiday shopping is well underway: one in three have already started, though most plan to begin in November.

2025 Holiday Spending Start Date

- I’ve already started 31%

- Early November 9%

- Mid-November 18%

- Late November 21%

- Early December 14%

- Mid-December 5%

- Late December 2%

Note: Of those who started their holiday shopping already, 68% began in September.

Most will do some of their holiday shopping online, and over 1 in 3 will exclusively shop for holidays online, with Amazon a top choice

%

Online

%

In-store

%

Equally online & in-store

Top 3 Online Shopping Channels

- On online marketplaces, like Amazon 81%

- On store or retailer websites 57%

- Directly from brands on their own websites 42%

Top 3 Store Types Shopping At For 2025 Holiday Season

- Big-box retailers (i.e., Walmart, Target) 70%

- Supermarkets / grocery stores (i.e., Kroger, Safeway) 44%

- Department stores (i.e., Macy’s, Kohl’s) 36%

In-store retail continues to be crucial, with big box and warehouse retailers being go-to destinations for Americans.

2 in 5 Americans indicate that they expect to spend less money on the holidays this year, due to rising costs, reduced disposable income, and focusing on meaningful spending.

How Much Do Americans Plan to Spend on the Holidays?

- I expect to spend A LOT MORE 4%

- I expect to spend SOMEWHAT MORE 19%

- I expect to spend the SAME as last year 39%

- I expect to spend SOMEWHAT LESS 22%

- I expect to spend A LOT LESS 16%

Top Reasons for Spending Less

Rising Costs & Inflation

Our budget has been cut dramatically because of the rising cost of food, utilities, and everyday expenses

– Male, 46, CT

I have less money than I have in previous years due to inflation.

– Female, 32, NH

Reduced Disposable Income

Since we’ve been spending more on necessities our budget can’t handle spending too much on Christmas.

– Female, 32, NC

Money is tight! Less hours at work and credit card debt.

– Female, 65, PA

Reusing & Reprioritizing

I will be spending less because I plan to buy less and reuse anything I can from last season.

– Male, 50, CA

Spending less on gift wrapping due to a large amount left from last year.

– Male, 53, FL

Hear directly from Americans on how they’re navigating this year’s holiday shopping season:

While many are cutting back in smaller categories, a notable share still plan major purchases: nearly 3 in 10 for large purchases and 1 in 5 for vacations—signaling selective spending on higher-value experiences or items.

Top 5 Categories Spending LESS On

Among Purchasers of Category

- Cards & Gift Wrap 45%

- Christmas Trees/Decorations 39%

- Parties 38%

- Home/Kitchen Items 35%

- Clothing & Winter Wear 34%

% Intend to Make A Large Purchase This Holiday Season

i.e. Car, Boat, Appliance, Major Electronic Device

%

% Intend to Take a Vacation This Holiday Season

Including Domestic and Foreign

%

Costs being too high and simply not having a need are the top reasons holding Americans back from making large purchases this holiday season.

Despite concerns around cost and affordability, tariffs are unlikely to cause notable changes for Black Friday or Cyber Monday shopping.

While 3 in 4 Americans indicate major sales like Black Friday or Cyber Monday have at least some impact on their holiday shopping, most don’t anticipate leaning on these sales more than previous years.

Influence of Major Sales on Holiday Shopping (i.e. Black Friday, Cyber Monday, etc.)

- A lot – I plan my holiday shopping around these events 13%

- Somewhat – they influence a few of my purchases 35%

- A little – I might buy something if there’s a great deal 27%

- Not at all – these events don’t affect my shopping plans 24%

Relying on Major Sales for Holiday Shopping (i.e. Black Friday, Cyber Monday, etc.) This Year

- More than in previous years 16%

- About the same as previous years 46%

- Less than in previous years 11%

- I don’t usually shop during these events 27%

Streaming services could take a hit as Americans look to tighten their purse strings this holiday season.

Consumers are largely holding steady on streaming, with few adding new subscriptions and about 1 in 7 cutting back to reduce spending.

Plans to Sign Up For Streaming Services

- Planning to subscribe to new streaming services 3%

- Planning to re-subscribe to streaming services I used before 7%

- Sticking with what they already have 75%

- Planning to cancel or pause streaming subscriptions to save money 14%

Netflix, Hulu and Prime Video are the main services Americans show interest in signing up for.

A word on our approach...

Fine Print:

A Nationally Representative Angus Reid Group Sample

Sample Size: n= 437 Americans aged 18+ years old

Fieldwork dates: November 4-10, 2025

Mobile Chat

Thank You:

Thank you for joining us this fall as we explored how economic policies and tariffs are influencing daily life. From shifting consumer choices to evolving financial outlooks, this research has helped us uncover how these forces are shaping the months ahead.

Curious to know more?

Email marketing@reach3insights.com or

use the Contact button below.

www.reach3insights.com

info@reach3insights.com // SMS: (833) 4Reach3 // Phone: (833) 4Reach3